Economic impact of Hurricane Harvey: One of the most destructive in U.S. history

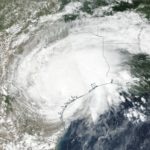

After barreling into the state of Texas, as one of the largest and most damaging Hurricanes in U.S history, Hurricane Harvey continues to devastate the Corpus Christi-Houston-Galveston area with catastrophic destruction, human losses, and unprecedented flooding.

As the region begins to pick up the pieces in the weeks, months and years to come, there is a growing concern about the impact that Hurricane Harvey will have on the regional and national economy.

Storms of this magnitude can devastate local economies, resulting in significant economic and physical damages. This was the case of Hurricane Katrina (2005) and Superstorm Sandy (2012), which resulted in property losses of around $160bn and $70bn, respectively.

Storms of this magnitude can devastate local economies, resulting in significant economic and physical damages.

In general, gross losses from natural disasters can be divided in lost value of capital stock and loss of short-term investment flows. Net losses take into account the gains from reconstruction activity. In terms of value-added, the destruction of capital stock - housing, commercial property, infrastructure and inventories - by itself does not reduce the level of current production or income. However, it does reduce wealth, the value of services of capital stock and tax revenues – mainly property taxes. This in turn causes a reduction in income, consumption, trade and investment, which reduces the level of economic activity, particularly over the short term.

Meanwhile, the immediate reduction in short-term investment flows reduces the level of economic activity through lower hours worked, income, sales, output, tax revenues and trade. Moreover, since the direct effects also have second round effects across different sectors, the total negative impact is augmented. An additional risk to the region is maintaining its economic attractiveness over the longer-run, as devastating weather events may force people to move out and deter both future investment and migration, thereby reducing economic potential. For example, after Hurricane Katrina in 2005, New Orleans’ nonfarm payroll declined almost 200 thousand and after 12 years, payroll is still 7% lower than before the storm.

According to our estimates, Harvey’s economic cost could reach $60bn. However, these figures could increase as Harvey is expected to make a second landfall somewhere near the Louisiana-Texas border.

According to our estimates, Harvey’s economic cost could reach $60bn.

The negative impact tends to be large at first, but as conditions normalize, economic activity is positively affected as long as insurance and assistance funds are made available. Private insurance, FEMA, and federal and state relief programs help the rebuilding, repair, renewal and restoration of damaged capital stock. Therefore, the net economic cost will end up being significantly lower after reconstruction activity compensates lost value-added. Not surprisingly, most studies that focus on the net economic effects of natural disasters – excluding the lost value of capital stock – tend to arrive at relatively low figures, once both negative and positive effects are accounted for.

These results are consistent with our analysis on the effects of large storms on economic activity at the state and national level, which indicate that the negative effects of the storms subside and reverse within 12 to 18 months. Furthermore, our analysis suggests that in 2017 and 2018, Texas real GDP growth will be around 3.7% instead of 4.3%, and 4.1% instead of 3.8%, respectively.

However, full replacement of capital assets may never happen and the recovery may take place over a longer period of time than initially expected. In fact, a large share of lost property, particularly for households and small businesses will not be covered by insurance policies. That is why federal and state aid become so relevant, particularly in cases of severe flooding. According to FEMA, the estimated balance of the Disaster Relief Fund for September 2017 will be less than $1.5bn. This implies that Congress will have to act quickly to appropriate relief funds for Hurricane Harvey.

In addition to the regional effects, there would also be an impact on the U.S economy. In the short-run, we can expect volatility in national and regional labor market indicators, spillovers to consumption from earning losses and higher gasoline prices, and a drawdown in crude inventories from inactivity in the gulf coast upstream and downstream activity.

In addition to the regional effects, there would also be an impact on the U.S economy.

Disruption to refining activity could have a significant impact on gasoline prices. According to the Department of Energy, as of August 28, 19% of oil production and 18% of natural gas production in the Gulf of Mexico was shut-in. A total of ten refineries (6 in the Corpus Christi area and 4 in the Houston/Galveston area) are shut down. These ten refineries have a combined capacity of 2.2 million b/d, equivalent to 43% of total Texas Gulf Coast capacity and 12% of total U.S. refining capacity. In addition, four other refineries in the Houston-Galveston-Beaumont-Port Arthur area were operating at reduced rates and two more were considering shutting down. If refineries are capable to restore operations swiftly, gasoline prices could decline quickly and the net effect on U.S. private consumption will be modest. For example, in the aftermath of Hurricane Katrina in 2005 and Hurricane Ike in 2008, the increase in gasoline prices was 17% and 5%, respectively. However, prices edged down and soon returned to pre-storm levels.

As with the regional effects, given that the recovery effort will be massive, there is a chance that net economic conditions will be largely unchanged relative to our baseline scenario.

Given that the recovery effort will be massive, there is a chance that net economic conditions will be largely unchanged relative to our baseline scenario.

As such, the net economic impact at the national level to will be small, and thus we are maintaining our baseline forecast for GDP growth in 2017 at 2.1%. That said, there is a possibility that the 3Q17 estimate will fall below our previous projections of 2.6%; although, we anticipate that gains in 4Q17 should offset any weakness in the third quarter.

Similarly, we do not expect the rise in gasoline prices or the short-term economic headwinds to prompt the Fed to abandon its current course of removing accommodation. If conditions in the energy sector remain dire the Fed could delay further rate increases. Likewise, if the shock to gasoline prices leads to a persistent rise in inflation, the Fed could become slightly more hawkish. However, deviating from its current policy course is unlikely as far as these shocks are seen as transitory. As a result, we maintain our baseline scenario unchanged.

Based on our analysis of the effects of the storm on the banking industry, the likely outcomes include higher delinquency rates and deterioration in the quality of posted collaterals in the affected areas. Nonetheless, large and diversified banks should be able to overcome the obstacles more smoothly. Meanwhile, lending activity could accelerate as businesses and consumers engage in reconstruction efforts. In fact, banks have an important role to play in the recovery from the economic disaster and human suffering that Hurricane Harvey has inflicted.

Finally, besides the challenges of reconstruction, the magnitude of Hurricane Harvey highlights the effects of rising sea temperatures, the severe risks from climate change and the urgency to take action at every level of society to minimize the impact of an ever increasing number of super storms.

Any statement or opinion of an economist affiliated with BBVA Compass is that economist’s own statement or opinion and does not represent a statement or prediction by BBVA Compass, its parent companies or management.

For more stories and articles related to Hurricane Harvey, click here.

Click here to make a contribution to those affected by Hurricanes Harvey and Irma. The BBVA Compass Foundation will match donations up to $150,000.

For more information on how BBVA Compass is helping those impacted by Hurricanes Harvey and Irma, click here.>