The crux of complex decisions

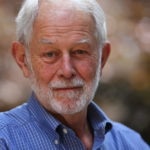

In his youth, Robert Butler Wilson (Geneva, Nebraska, United States, 1937) was strongly drawn to basic science. With the help of a grant, he was able to fulfill his dream of studying mathematics at Harvard University, where he graduated in 1959. However, his fortuitous attendance at an economic theory course convinced him to switch to the social sciences.

Around the same time, Howard Raiffa, his mentor and a leading theorist of the art of negotiation, introduced him to decision theory, an interdisciplinary field that studies the behavior of decision-makers and the conditions that inform their choices. This would prove a watershed in his career.

“I discovered that many issues of economic analysis could be solved with the techniques of multi-person decision theory, including game theory,” explains Wilson, recalling the impression that it made on him. With time, he also began looking at basic problems of economics, particularly those to do with strategic behavior. “I wanted to contribute to basic theory on the subject of how rational people analyze complex decision problems,” he relates.

And the next step was to complete his training with a doctorate in business administration (1963). He started work at the University of California, but shortly moved to Stanford where he would remain for the rest of his teaching and research career, since 2004 in the emeritus post of Adams Distinguished Professor of Management.

It was the 1960s, and game theory was booming after John Nash enlarged and refined its theoretical postulates. Wilson, however, was skeptical about its value as an economic analysis tool. “The complexity of the models made them hard to use in empirical estimates, we needed better modeling and analysis techniques,” he clarifies. With this goal in mind, he was among the first to analyze market situations from the perspective of non-cooperative game theory, especially in conditions of information asymmetry.

In 1982, along with colleague David Kreps, he developed the concept of sequential equilibrium, seeking to determine which equilibria are reasonable and which not in a game with asymmetric information. As Wilson explains it: “We turned game theory into a more useful method for analyzing economic interactions.”

We turned game theory into a more useful method for analyzing economic interactions — Wilson

Sequential equilibrium and its variants are currently in wide use as an economic analysis tool in multiple areas including industrial organization – for instance, to combat the practice of predatory (below cost) pricing – and in practices like wage bargaining. It is for these “pioneering contributions to the analysis of strategic interaction when economic agents have limited and different information about their environment,” that the jury has granted him the BBVA Foundation Frontiers of Knowledge Award in Economics, Finance and Management.

Treasury room at BBVA in Madrid

In his work, he has consistently wed the construction of a robust theoretical framework with the search for practical solutions. A difficult endeavor, undertaken at times alone at times as part of a team, but invariably supplemented by “careful observation and a spark of creativity that illuminates the crux of the problem.” It follows, then, that his work has found outlets in other fields like industrial economy, where he has made landmark contributions in tariff design and price discrimination.

What do electricity rates and air fares have in common? Both are examples of what is known as nonlinear pricing, where the prices available to the consumer are not proportional to the quantity acquired; a standard commercial practice which, as the jury remarks, at one time occupied much of Wilson’s attention. His theoretical insights in this area are set forth in Nonlinear Pricing, published in 1993 and now a classic textbook on the subject.

Wilson admits that although the desire to understand the intrinsic details of market operation (how and by whom prices are determined) was a primary career motivation, with time he felt closer to what has become known as economic engineering; putting economics to work to improve the design of markets.

Hence his groundbreaking work on auction design, with the focus on divisible good auctions in an asymmetric environment with private information – an example being the tenders used by central banks to set their policy interest rates. Where his imprint has been strongest, however, is in the power and telecommunications markets and auctions for oil drilling rights. Moreover, his innovative models have enabled many governments to improve their licensing procedures and save on public procurement costs.

During a prolific career in teaching and research, he has invariably been guided in his choice of subject by the observation of practical problems. He has authored over a hundred published papers in leading international journals, and his influence extends across a multitude of disciplines, from finance to business strategy. Recently, he has been studying the limitations imposed on cooperation between two parties. But his passion, he admits, is to “establish firmer foundations for game theory and its applications."