Corporate information

Letter from the Chair

Dear shareholders,

2024 was a great year for BBVA, a year in which we once again stood out among European banks for our ability to combine growth and profitability. This strength has a positive impact on our shareholders, customers, employees and society as a whole.

Last year, we obtained our best results in history, with a net attributable profit of €10.05 billion, up 25 percent from 2023. Our return on tangible equity (ROTE) reached 20 percent, making us one of the most profitable banks in Europe. Furthermore, our tangible book value per share plus dividends paid, increased an average of 18 percent per year over the past three years.

These robust results allow us to continue reinvesting in our business and to maintain attractive distributions to our shareholders. Against 2024 results, we will distribute over half of our profit, more than five billion euros, including dividends and share buybacks. At the Annual General Meeting we will hold on March 21st, we will propose a €0.41 cash dividend per share which, together with the €0.29 paid in October, will raise the cash dividend per share to €0.70, a 27 percent increase over the previous year. In addition, in the coming months, we will also be implementing a new €993 million share buyback program.

This way we will have allocated over €18 billion to dividends and share buybacks since 2021, a sign of our firm commitment to value creation and shareholder distributions.

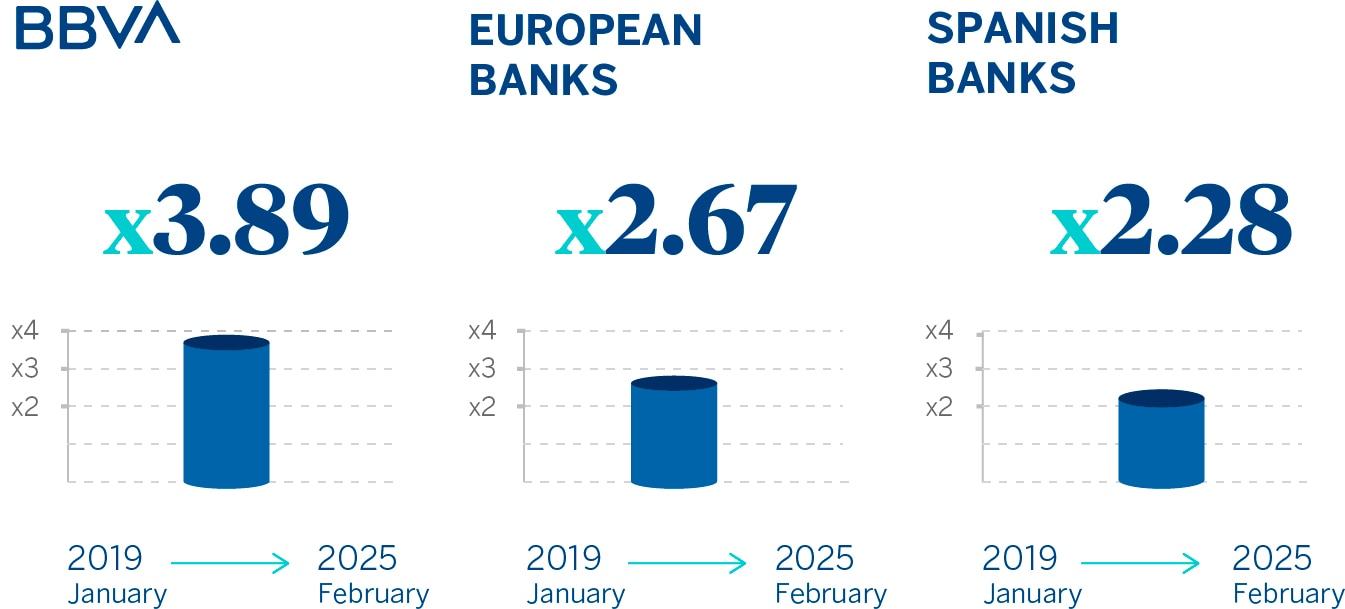

If we consider a broader timeframe, since the beginning of 2019, the value of our shareholders’ investment, which includes both dividends and stock performance, has nearly quadrupled. This represents a total return that is far superior to European and Spanish competitors (which have multiplied their investments by 2.7 and 2.3, respectively).

Total shareholder return (accumulated since 2019)¹

¹Total return includes evolution of stock performance + dividends: Stoxx Europe 600 Banks. Spanish banks: BKT, CABK, SAB, SAN, UNI weighted by market capitalization. Data from 01/01/2019 to 28/02/2025

We believe that banks play a fundamental role in economic progress and social well-being. We channel savings into productive investments, provide financing to families and businesses, and promote inclusive growth. This commitment is reflected in the significant increase in activity in 2024: lending rose by 14.3 percent year over year in the Group, which allowed 160,000 families to purchase a home. In addition, we provided new financing to 715,000 small and mid-sized companies and the self-employed, boosting their growth, and 70,000 larger corporations had access to BBVA financing as of the end of the year. Furthermore, over the past year, we allocated €22 billion to finance social infrastructure and support entrepreneurs.

In 2024, over 11 million new customers joined BBVA, reaching a total of 77.2 million active customers. Our pioneering, decisive approach to digitization has been key, with 66 percent of these new customers joining through digital channels. Today, three out of every four customers interact with BBVA on mobile devices and the number of digital transactions per customer per month has multiplied by 2.5 since 2020. Even more importantly, customer satisfaction continues to grow: our net promoter score (NPS) has improved 10 percentage points since 2019, and we remain leaders in our key markets.

BBVA is also a role model in sustainability. At the end of 2024 we achieved our target of channeling €300 billion into sustainable business since 2018, one year ahead of schedule.

Beyond our financial activities, at BBVA we are firmly committed to the places where we operate. Last year, we contributed to the recovery following the devastating DANA storm that impacted eastern Spain. From the first moment, BBVA put measures in place to support its customers in returning to normal in their lives and businesses, and to contribute to the recovery of the territory. Our commitment to the recovery of this region will continue in 2025.

Furthermore, together with the BBVA Foundation and the BBVA Microfinance Foundation, we allocated €567 million to social initiatives, benefiting nearly 106 million people and supporting cultural progress and innovation, while promoting inclusive growth.

A bank prepared for the future

Despite the global uncertainties, the economic outlooks for our main countries remain favorable. In Spain, we expect the economy to continue growing above the European average, bolstered by strong consumption and investment. In Mexico, activity remains strong, backed by its proximity to the United States and cost competitiveness, while low levels of banking penetration continue to provide the financial sector opportunities for growth. Turkey is showing favorable dynamics thanks to orthodox economic measures and its strategic position as a manufacturing powerhouse close to the European Union. In addition, we see positive dynamics and potential for the expansion of financial services in the main countries where we operate in South America.

These trends, combined with the strength of our franchises and our strategy based on innovation, digitization and sustainability allow us to face 2025 with optimism. In this regard, we expect BBVA to maintain profitability levels similar to those of 2024.

Europe is facing the challenge of accelerating growth and strengthening the continent’s competitiveness in an increasingly fragmented global environment. The European Commission estimates that the region needs an annual investment of more than €700 billion to modernize infrastructure, boost technological transformation and finance the energy transition. In order to address this challenge, the EU needs stronger, more efficient banks with the right scale to channel the enormous savings available to these investments.

It is in this context that we have proposed the union with Banco Sabadell, a transaction that poses a great opportunity for customers, employees and shareholders of both banks, as well as society as a whole. The integration combines the strengths of two highly complementary banks, so we can together achieve goals that would not be possible separately. Shareholders will benefit from the value generated from synergies, with greater potential for earnings per share appreciation and the commitment to maintain our value creation policy over the long-term, with increases in total shareholder return over time.

I would like to take this opportunity to thank you, our shareholders, for your firm support of the transaction at the Extraordinary General Meeting in July. We continue moving forward to obtain the pending approvals, so we can officially start the period for Banco Sabadell shareholders to join this great project.

Finally, after far surpassing the goals outlined in the 2019-2024 strategic plan, we are beginning a new strategic cycle. We carried out a comprehensive review of current trends and established new priorities for the 2025-2029 cycle, which will allow us to face future challenges and reinforce our position as a leader in the sector. We have also redefined our purpose: “Support your drive to go further.”

Among these new priorities, adopting a new perspective toward customers stands out, aiming to have a more profound, positive impact on their lives. Furthermore, we remain fully committed to sustainability, with an emphasis on growing in all business segments, and to fostering, throughout the organization, a value and capital creation mindset. In addition, we aim to maximize the potential of artificial intelligence and innovation by using data and next generation technologies. All of this will be possible thanks to our empathetic, winning team, focused on creating value for all stakeholders.

In this regard, I would like to thank each and every one of the nearly 126,000 people who make up BBVA. This team is a key pillar of our success and it is essential to underscore their dedication and commitment. I am convinced that together, we will continue to successfully face the challenges of the future.

And to you, our shareholders, I would like to reiterate my gratitude for your confidence and constant support, which drives us to continue consolidating our leadership in the sector and contributing to economic and social progress.

Letter from the Chief Executive Officer

Dear shareholders,

Over the past year, we achieved our best results ever, moving forward with determination in our strategy for profitable growth, and consolidating our leadership in efficiency and profitability in the European banking sector. This has allowed us to greatly surpass the targets we set for ourselves at the 2021 Investor Day. All of this despite facing an environment of uncertainty, marked by the gradual decrease in interest rates in many countries where we operate.

The BBVA Group’s net attributable profit reached €10.05 billion, our highest figure in history. This represents a 25 percent increase over the previous year.

This growth was bolstered by excellent evolution in net interest income, which rose 13 percent at constant exchange rates, and by solid growth in income from net fees and commissions, which increased 31 percent. This outstanding performance is a reflection of the momentum in our banking activity in the main markets where we operate, especially Spain and Mexico, where we continued to gain market share and strengthen our competitive position.

Operating expenses rose 18 percent year on year at constant exchange rates, due to growth in the workforce and the higher level of investments in recent years. However, these expenses rose less than income and the average inflation rate in the countries where BBVA operates. As a result, we continued to improve our efficiency, a key factor in our results, with a ratio that stands at 40 percent—226 basis points better than in 2023. Yet another year, we therefore remain one of the leading banks in efficiency among our group of European competitors.

Operating income, or the difference between the income generated and the costs incurred, reached €21.29 billion, up 30 percent from the previous year, excluding the impact of currency fluctuations.

Risk indicators remained in line with expectations. The cost of risk stayed stable at 1.43 percent, while the NPL ratio improved to 3.0 percent, and the coverage ratio rose to 80 percent.

Yet another year, BBVA’s profitability metrics have also improved. The ROE reached 18.9 percent, and ROTE 19.7 percent, well above the target of 14 percent set by the bank for the end of 2024. This profitability once again puts us in a leading position among European banks.

Thanks to these excellent results, we continued to create high value for you, our shareholders, with a tangible book value per share plus dividends 17.2 percent higher than the previous year. Regarding the Group’s capital, the fully loaded CET1 ratio remained strong, rising to 12.88 percent一well above the bank’s target range of 11.5 to 12 percent.

I would also like to underscore that this year we completed the 2019-2024 strategic cycle, far surpassing our forecasts and consolidating BBVA as a leading bank in growth, profitability and efficiency, with a unique profile among our European competitors. We remain firmly committed to creating value for all our stakeholders: customers, employees, shareholders, and society as a whole.

As for the main business areas, I would like to emphasize the following:

- Spain has benefited from 3.2 percent growth in GDP, which has made it possible to increase lending by more than 4 percent during the year, with a focus on the most profitable segments: commercial banking and consumer loans. The area’s profit rose to €3.78 billion, up 39 percent over the previous year thanks to the positive evolution of core revenue.

- In Mexico, with a GDP growth of 1.2 percent, our lending increased by 16 percent excluding currency fluctuations, with significant gains in market share. This momentum in activity has translated into growth in core revenue, which has offset the increase in costs amid an environment of gradual normalization of inflation. As a result, BBVA obtained a net attributable profit of €5.45 billion, up 5.8 percent from the previous year, excluding currency fluctuations.

- Turkey posted a net attributable profit of €611 million in 2024, a 16 percent increase over the previous year. This was possible thanks to growth in fees and commissions and NTI, which helped to offset pressure on net interest income; and the increase in provisions to normalized levels. This demonstrates the strength of our franchise in the country in a macroeconomic environment that remains complex, despite showing positive signs thanks to lower inflation rates.

- South America improved its net attributable profit, reaching €635 million. This was due to solid core revenue and greater lending, which increased 17 percent year over year, especially in commercial banking.

BBVA’s notable strengths have allowed us to obtain our best results ever. First, we have franchises that are leaders in their respective countries, with market shares that position them among the largest banks. We have managed to increase this market share in nearly all countries. Second, our results are a reflection of the success of our strategy, based on digitization, innovation and sustainability.

Finally, I would like to express my sincere gratitude to the nearly 126,000 people who work at BBVA for their dedication and hard work, and to all of you, our shareholders, for your constant support and confidence.

Kind regards,

History of BBVA

The history of BBVA is the history of many different people; people who have been a part of the more than one hundred financial institutions that have joined our corporate journey since it first began in the mid-19th century. Today, at BBVA we work to support our clients their drive to go further..

BBVA in the world

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey. In the United States, BBVA also has a significant investment, transactional, and capital markets banking business.

BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.

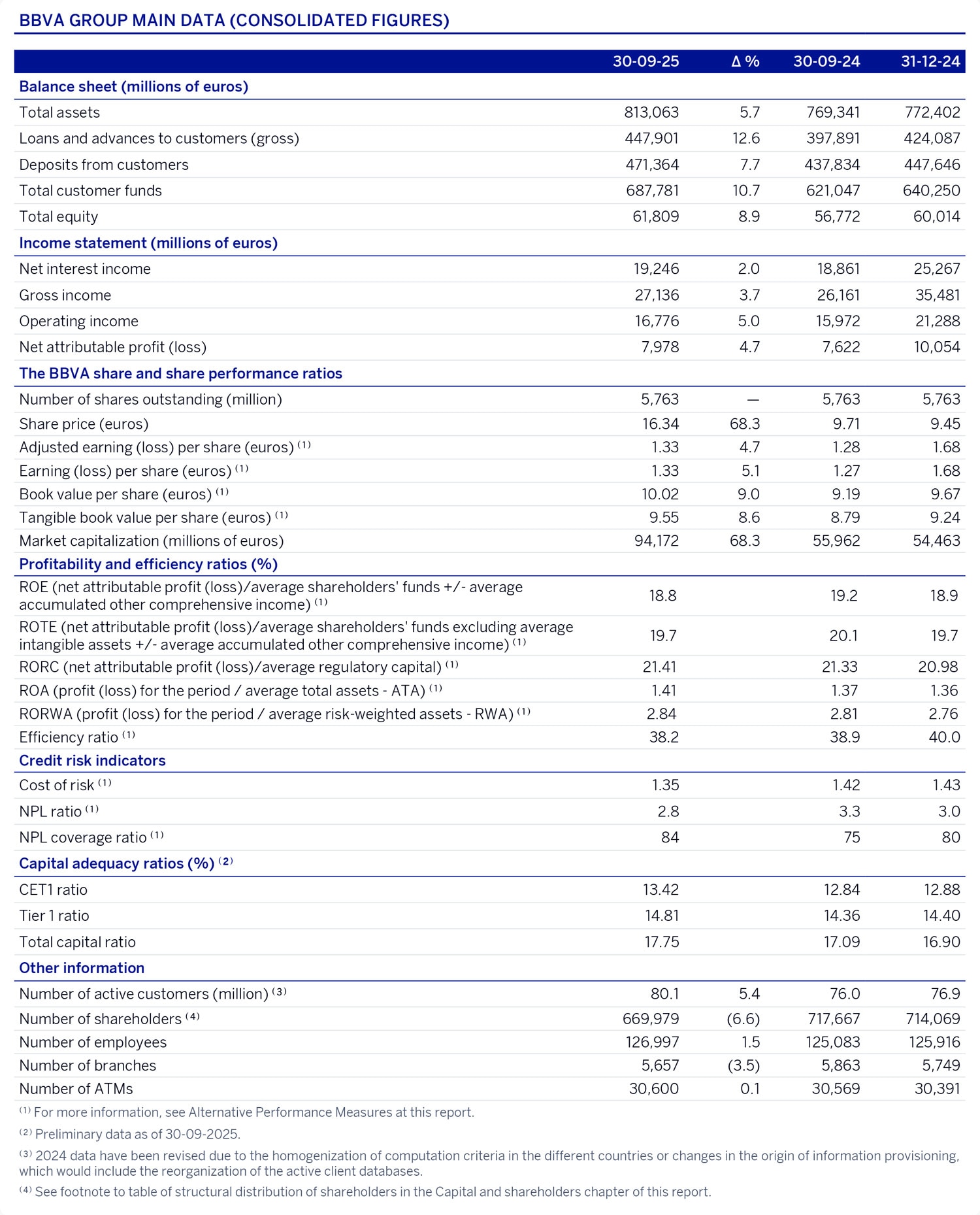

Basic data

Relevant data of the BBVA Group (consolidated figures) at 30-09-2025. This section contains all the updated quarterly figures on the balance sheet and income statement, and other relevant data.

More financial information is available on the Shareholders and Investors website.

-

-

Business UnitsBusiness Units

-

Javier Rodríguez Soler Sustainability¹ / Corporate & Investment Banking

-

Jaime Sáenz de Tejada Commercial Client Solutions

-

David Puente Retail Client Solutions

-

Murat Kalkan Digital Banks

-

Jorge Sáenz de Azcúnaga Country Monitoring²

-

Peio Belausteguigoitia Country Manager Spain

-

Eduardo Osuna Country Manager Mexico

-

Mahmut Akten Country Manager Türkiye

-

-

Global FunctionsGlobal Functions

-

Luisa Gómez Bravo Finance

-

José Luis Elechiguerra Global Risk Management

-

-

-

-

TransformationTransformation

-

Carlos Casas Engineering

-

Paul G. Tobin Talent & Culture

-

Antonio Bravo Data

-

-

StrategyStrategy

-

Victoria del Castillo Strategy & M&A

-

Paula Puyoles Communications

-

Juan Asúa Senior Advisor to the Chair

-

-

Legal and ControlLegal and Control

-

María Jesús Arribas Legal

-

Domingo Armengol General Secretariat

-

Ana Fernández Manrique Regulation & Internal Control³

-

Carlos Sanz-Pastor Internal Audit³

-

-

Organizational chart

Organizational structure

BBVA’s organizational structure meets the objective of continuing to promote the transformation and businesses of the Group, while advancing in the delimitation of executive functions.

The Chair is responsible for the management and proper functioning of the Board of Directors, the supervision of the Group’s management, institutional representation, and leading the Group’s strategy and transformation process. Meanwhile the Chief Executive Officer (CEO) is in charge of the daily management of the Group’s businesses, reporting directly to BBVA’s Board of Directors.

Additionally, certain control areas (Internal Audit and Regulation & Internal Control) report directly to the Board of Directors through its corresponding committees.

Strategy

The current macroeconomic environment is marked by geopolitical tensions, a normalisation of interest rates and an increasing ageing of the population, which will generate challenges and opportunities in the financial sector.

In addition, the rest of the long-term global trends on which BBVA's strategy is based and which play a critical role in the transformation of the economy have continued to consolidate and evolve.

- Digitization has continued to solidify across most sectors, ushering in a new era of disruption driven by artificial intelligence (AI). AI is redefining competitive dynamics across numerous industries, including the financial sector, and its impact on the entire value chain is creating significant opportunities:

-

- Hyper-personalization of value propositions.

- Process automation, expected to have a profound effect on middle and back-office tasks, improving data control, productivity, and customer experience.

- The continued advancement of technologies such as blockchain, quantum computing, and cloud processing, which are opening up a transformative era of opportunities for society and the financial industry.

At the same time, the financial system is navigating an increasingly complex competitive landscape, with the rise of new digital competitors, such as neobanks, and non-bank players disrupting traditional models.

- Sustainability will remain a key driver of economic growth:

-

- Investments in the transition to a decarbonized economy are gaining momentum, fueled by increasing energy demand and the cost-effectiveness of renewable energy sources. Additionally, profitability in emerging technologies is rising, thanks to ongoing innovation. It is currently estimated that approximately half of the emissions reductions required will come from technologies that are still in their early stages and unproven on a large scale.

- Banks will play a crucial role in this transition by channeling investments and providing guidance to their clients as they move toward a decarbonized and more energy-efficient economy in the context of growing energy demand.

- Moreover, investments aimed at enhancing production processes and improving the value chains of companies that contribute to preserving natural capital are also on the rise. Reversing the depletion of natural capital is essential due to the significant economic and financial impacts it entails.

Purpose and values

BBVA’s strategy revolves around a single Purpose: “Support your drive to go further”.

- Support means being consistently present, especially during life’s most critical moments. It involves providing ongoing assistance to customers, actively listening to them, understanding their needs, and adapting accordingly. At the heart of this is empathy: it allows BBVA to connect deeply with its customers, aligning with their concerns, aspirations, and dreams, and becoming a trusted ally that genuinely understands what its customers need.

- Your drive. BBVA understands that behind every project, every goal, and every step forward lies something deeper: a drive. It’s that inner strength that inspires people to excel, pursue their ambitions, and believe in a brighter future. It’s the determination to keep moving forward, the motivation fueling them every day.

- To go further embodies the spirit of progress and innovation. It reflects an attitude that is deeply ingrained in BBVA’s DNA, always striving to anticipate, to envision today what the future holds, and to approach tomorrow with optimism. This ability to foresee and adapt creates immense value for the individuals and businesses that choose BBVA as their trusted partner to achieve their dreams.

The customer comes first

BBVA places customers at the center of its activity, before anything else. The Bank aspires to take a holistic customer vision, not just financial. This means working in a way which is empathetic, agile and with integrity, among other things.

- We make our customers’ needs our own: we take on our customers’ needs as our own, responding swiftly and effectively. We anticipate challenges and provide continuous support.

- We are empathetic: we put ourselves in others’ shoes, listen attentively, tailor our response to their needs, and act with respect to ensure everyone feels valued.

- We have integrity: we always act with honesty, in compliance with the law and BBVA’s internal regulations, without tolerating inappropriate behavior. We are a trusted partner, providing support with transparency and responsibility.

We think big

It is not about innovating for its own sake but instead to have a significant impact on the lives of people, enhancing their opportunities. BBVA Group is ambitious, constantly seeking to improve, not settling for doing things reasonably well, but instead seeking excellence as standard.

- We are ambitious: we drive a positive impact on people’s lives and society as a whole. We support their desire for growth and progress.

- We are innovators: we stay ahead of challenges by offering agile and effective solutions. We create value-driven proposals to help our customers go further.

- We exceed customer’s expectations: we create effective solutions that exceed customer expectations. We help individuals and businesses reach their full potential.

We are one team

People are what matters most to the Group. All employees are owners and share responsibility in this endeavor. We tear down silos and trust in others as we do ourselves. We are BBVA.

- I am committed: I take on the bank’s objectives as my own, feeling a genuine connection with BBVA’s values and purpose, which drives me to work with passion and enthusiasm.

- I trust others: we collaborate with generosity and trust, ensuring clear and respectful communication. Together, we drive the growth of our customers and our team.

- I am BBVA: we are a global and diverse team that shares a common purpose and creates a positive impact. We support, inspire, and drive people and businesses to reach further.

Strategic priorities

BBVA has defined six strategic priorities, focusing on:

- Differentiation.

- Full commitment to growth and value creation.

- Meaningful impact across the board.

1 - Embed a Radical Client Perspective in all we do

- It is the core of our strategy and impacts everything we do.

- The goal is to offer a value proposition focused on the needs of our clients and their financial health, ensuring a coherent, fluid and quality experience across all their channels.

- A new way of interacting with our clients with a focus on hyper-personalization and real-time contextualization, taking advantage of new technologies such as artificial intelligence.

- Achieving excellence in execution, always being available and ensuring that 100% of interactions are positive.

2 - Boost sustainability as a growth engine

- BBVA was a pioneer in identifying the impact of sustainability on competitive dynamics in all industries, including both the environmental and social axis.

- Sustainability must become a driver of differential growth in the banking business, taking advantage of the need to finance investments to meet a growing demand for efficient and clean energy.

- Specialized advice tailored to each market segment and the transformation of risk processes are key to generating differential growth.

3 - Scale up all enterprise segments

- BBVA wants to be the benchmark bank for the business segment (SMEs, companies, institutions and large corporations, which will be a key driver of differential growth.

- We have great competitive advantages, such as our presence in 25 countries, which allows us to better meet the needs of global companies, and also our specialization in sustainability.

- A stronger corporate business that complements the retail business, offering a comprehensive universal banking proposal compared to new competitors with a presence only in the retail segment.

- BBVA wants to promote this priority, taking advantage of the radical focus on the customer, with specialized advice and through the continuous improvement of its digital capabilities and technological platforms, with a focus on optimizing risk processes to speed up response times.

4 - Promote a value and capital creation mindset

- We want to continue to advance in the concept of profitable growth, closely linked to our strategy and the generation of long-term value.

- All processes must consider value creation as a critical factor for decision-making. This implies changes in management models, incentives, monitoring and reporting. Initiatives such as balance sheet rotation are key to optimizing the use of capital and maximizing profitability, while allowing for a greater positive impact on the client.

- This priority reinforces the importance of low-capital consumption and high-value creation businesses such as: insurance, private banking, asset management and payment ecosystem.

5 - Unlock the potential of AI and innovation through data availability and Next Gen Tech

- Responsible use of data and new technologies has always been a key factor in BBVA's strategy.

- The availability of data is a critical step in being able to generate a differential impact throughout the value chain, both on customers, through a hyper-personalized proposal and added value, and on efficiency and control thanks to process automation.

- The evolution to new generation technologies (Next Gen) is essential to efficiently address all the requirements derived from hyper-personalization and increased interactions with customers.

6 - Strengthen our empathy, succeed as a winning team

- All of us who are part of the BBVA team are a fundamental factor in the execution of the strategy.

- We are a team that is proud to be part of BBVA, that connects with the purpose and values, that does not settle and always seeks excellence and a differential added value for the customer. For this reason, it is necessary to foster empathy throughout the organization to radically adopting the customer perspective.

- The new priorities require a team with a winning and ambitious character to continue leading the transformation.

Sustainable and responsible business model

In 2019, BBVA undertook a strategic rethinking process to further enhance its transformation and adapt to the key trends that are changing the world and the finance industry. Two of the primary trends identified are the fight against climate change and the growing importance of social inclusion. In this context, the strategic plan approved by the bank's Board of Directors in 2019 seeks to accelerate this transformation and the achievement of its purpose. The plan encompasses six strategic priorities, including "helping customers transition to a sustainable future" and "improving the financial health of our customers."

The fight against climate change poses one of the greatest disruptions in history, with unprecedented economic consequences. All actors in our global community (governments, regulators, companies, consumers and society in general) have to adapt to these changes.

The commitment to sustainability, responsible banking and the creation of long-term value for all stakeholders is reflected in the bank's various policies. Specifically, BBVA's Sustainability Policy sets out and establishes the general principles and main objectives and guidelines for the Group's management and control in the area of sustainable development. The policy seeks to achieve a balanced approach to economic development, social development and environmental protection.

BBVA has two key focuses of action in the sustainability domain:

- The fight against climate change and the protection of natural capital as drivers of the joint global effort to accelerate the shift to a net-zero emissions economy by 2050.

- Inclusive growth, where BBVA catalyzes change, thereby enhancing the well-being and economic growth of society, leaving no one behind and bringing the age of opportunities to everyone.

Based on these two focuses of action, BBVA has set three strategic sustainability objectives:

- Boost the growth of the Group's business through sustainability. Identify new opportunities, innovate by developing sustainable products and offer guidance to individuals and enterprises, while embedding sustainability risks in the Group's management processes.

- Achieve greenhouse gas emission neutrality. Reduce the Group's direct emissions and indirect emissions by helping customers to cut their own emissions, thus achieving net zero by 2050 at the latest, in line with the more ambitious goals of the Paris Agreement.

- Promote integrity in our relationship with stakeholders. Ensure a responsible relationship with our customers and suppliers, promote diversity and inclusion in our team, enhance transparency and encourage investment in the community.

The global Sustainability area is responsible for designing and supporting the execution of BBVA's strategic sustainability agenda and the development of business in this area, setting sustainability targets, and driving and coordinating the lines of work in this sphere conducted by the various areas. Therefore, implementing the sustainability strategy is a cross-cutting endeavour. It is the responsibility of all areas to progressively integrate sustainability into their strategic agenda and work dynamics. The area is responsible for raising awareness of BBVA's sustainability principles and aims while advising the executive units in charge of implementing them and ensuring that they are embedded in their activities and internal procedures.

Sustainable finance

Banks play a pivotal role in the fight against climate change and in achieving the United Nations Sustainable Development Goals, thanks to their unique position to mobilize capital through investment, lending, issuance and advisory functions. There are a number of key ways in which we can contribute to this challenge. First, by providing innovative solutions to customers to help them transition to a low-carbon economy and by supporting sustainable finance. Secondly, we systematically mainstream social and environmental risks into our decision-making.

For BBVA, sustainability is already a lever for growth. In November 2022, BBVA again raised its sustainable mobilization target to €300 billion between 2018 and 2025, a threefold increase over the initial target.

Commitment to the community

BBVA's 2021-2025 community commitment focuses on communities or groups in conditions of vulnerability, inequality or lack of protection.

The ultimate goal of the plan is to provide resources, tools and support to improve the lives of disadvantaged people and thus contribute to inclusive growth. We seek to ensure that the benefits of economic growth are distributed fairly across society, thereby creating opportunities for everyone and leaving no one behind.

In the period 2021-2025, BBVA and its foundations will allocate €550 million to social initiatives to support inclusive growth in the countries where it is present. This is the most ambitious social plan launched to date by the bank.

Through a range of initiatives, BBVA will support five million entrepreneurs, help more than three million people receive a quality education and train one million people in financial literacy. In addition, the BBVA Microfinance Foundation will provide more than €7 billion in microloans. In total, these programs are expected to reach 100 million people during this period.

The 2021-2025 plan strives to respond to the key social challenges in each region. BBVA's community commitment is complementary to its pledge to channel €300 billion in sustainable finance over the 2018-2025 period.

The 2025 Community Commitment addresses four areas of action: reducing inequality and promoting entrepreneurship; creating opportunities for everyone through education; supporting research and culture; and encouraging volunteering among employees:

Reducing inequality and promoting entrepreneurship

BBVA undertakes initiatives to reduce social and economic inequality and promote entrepreneurship. The bank also promotes the financial inclusion of unbanked communities, and improves the financial health and resilience of people with limited access to financial services or those who are underserved.

Such activities include: support for low-income entrepreneurs through the BBVA Microfinance Foundation and other programs to support entrepreneurs, training in financial literacy to empower the population, promotion of financial inclusion, employability and digitalization, and social assistance programs for Ukraine war refugees.

- BBVA supports vulnerable entrepreneurs through various initiatives. One of the key players in this regard is the BBVA Microfinance Foundation, which closed 2022 cementing its position in the microfinance sector and celebrating 15 years of activity in which it has served more than six million entrepreneurs in five Latin American countries. For the fourth consecutive year, it has been recognized by the Organization for Economic Cooperation and Development (OECD) as the leading foundation in terms of contribution to development in Latin America.

- Financial education and literacy: At BBVA we believe in the potential of financial literacy as a key driver to improve financial health and aid the transition to a more sustainable economy. The 2021-2025 Global Financial Education Plan aims to train two million people and reach 50 million people receiving BBVA content on this subject. The plan, deployed in all countries within BBVA's footprint, has three lines of action in financial education: for society, to support businesses, and to encourage collaboration. In 2008, the bank launched its first Global Financial Education Plan. From then until 2022, BBVA has offered training programs in financial knowledge and skills in all the countries where it is present.

- War in Ukraine: In 2022 BBVA launched a community response plan to Russia's invasion of Ukraine to help alleviate the effects of the humanitarian emergency triggered by the war.

Creating opportunities for everyone through education

BBVA offers a wide range of initiatives to promote access to high-quality education. This includes programs to reduce the digital education gap, scholarships for access to high-quality education, and programs for the development of values and skills and in support of higher education and vocational training.

In addition, the bank partners with public education systems to create free, high-quality content that is distributed through a range of channels.Key initiatives in the field of education included:

- Aprendemos juntos 2030, a project recognized by the United Nations for its contribution to the SDGs. The contents of this initiative are related to a greener and more inclusive future and include the involvement of leading international figures.

- Chavos que Inspiran: The BBVA Mexico Foundation focuses its activities on education through its flagship program “Chavos que Inspiran” (Kids who Inspire). This initiative aims to transform the lives of young people with limited resources through scholarships and mentoring for 10 years. As a result of this project, it is estimated that 8 out of 10 scholarship recipients will be the first in their families to graduate from university, rise above the poverty line and achieve a socio-economic level that would otherwise have been unattainable for four generations.

- Educación Conectada is an initiative launched in 2020 by BBVA and the Fad Juventud Foundation in Spain, which aims to reduce the digital divide in the education system by promoting the digitalization of the entire educational community, from school management and teachers to families and students.

Support for research and culture

BBVA develops, mainly through the BBVA Foundation (“BBVAF”), various initiatives to support researchers and creators in the fields of science, culture and business, cultural reference institutions and scientific dissemination. The direct promotion of scientific research is one of the levers on which the FBBVA relies, along with the recognition of talent through awards such as the BBVA Foundation Frontiers of Knowledge Award.

Volunteering

The bank's corporate volunteering initiatives promote the collaboration of employees to generate a significant social impact, increase pride in belonging, satisfaction and productivity, and position BBVA as a benchmark company in corporate volunteering, increasing its attractiveness to existing and potential employees.

BBVA’s Code of Conduct

The Code of Conduct establishes the behavioral guidelines that, according to the principles of the BBVA Group, ensure that conduct adheres to the internal values of the Organization. To this end, it establishes the duty to respect applicable laws and regulations for all its members in an integral and transparent manner, with the diligence and professionalism that correspond to the social impact of financial activity and to the trust that shareholders and customers have placed in BBVA.

The Code was approved by the BBVA Board of Directors on July 30, 2024.

BBVA's Whistleblower Channel

A fundamental mechanism to guarantee the effective application of the regulations and guidelines of the Code of Conduct is the Whistleblower Channel, through which not only BBVA employees, but also other third parties not belonging to the BBVA Group can can confidentially and, if they wish, anonymously report any conduct that does not adhere to the Code of Conduct or that violates applicable legislation, including human rights-related complaints.

The Compliance area will handle complaints diligently and promptly. The information will be analyzed objectively and impartially and the identity of the whistleblower will be kept confidential. Those who report facts or actions in good faith through the Whistleblower Channel will not be subject to retaliation or suffer adverse consequences for this communication.

This Channel allows you to maintain, if you wish, a dialogue with the Manager of your complaint. For this purpose, we have designed a system (secure mailbox) that will allow you to communicate with BBVA, preserving your anonymity at all times.

The Whistleblower Channel is available 24 hours a day, 365 days a year from any computer or cell phone.

If you observe or someone informs you of an action or situation related to BBVA that may be contrary to the regulations or the values and guidelines of our BBVA Code of Conduct, please report it through:

Submit report on Whistleblowing Channel

The Whistleblower Channel is not the appropriate channel for dealing with customer complaints.

BBVA’s tax strategy

BBVA’s corporate principles for tax issues and fiscal strategy, approved by the Board of Directors.

BBVA Due Diligence

Know more about our regulatory framework, financials reports, Corporate Governance and Corporate Integrity Models.