A Brief History of BBVA (XVI): Banco de Bilbao and Banco de Vizcaya in the 1940s

Minister Benjamin’s Banking Law of 1946 further pulled in the already tight reins on the Spanish banking sector. In spite of everything, the two banks from Bilbao managed to grow and to distinguish themselves amongst their national competitors. Even before the greater growth that took place during the 1950s, Banco de Bilbao and Banco de Vizcaya had ended the 1940s in very good health.

Banco de Bilbao during the 1940s

The situation halfway through the 1940s was not easy for the banking industry. Even so, and against all predictions, Banco de Bilbao managed to grow significantly. Its numbers showed the steady but prudent direction the Basque bank’s managers had taken during a decade in which the economy struggled to recover but did achieve significant progress.

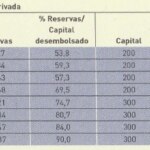

Loan demand was low and, given this situation, the Banco de Bilbao concentrated on its policy of reserves, which grew significantly more than the rest of the banking sector. Of note is the increase in the weight of reserves over paid-in capital during 1944 and 1947.

Comparison of reserves and paid-in capital of the banking sector and Banco de Bilbao during the 1940s - LIBRO CIENTO CINCUENTA AÑOS, CIENTO CINCUENTA BANCOS

Banco de Bilbao set its sights on developing its liabilities, out of the hidden saving that had taken place during the previous years, due to the three-year long civil war, which prompted a great austerity among Spaniards with a certain capacity for accumulation. The bank’s loans were made, above all, to borrowers with guarantees. Given the lack of muscle in the economy, Banco de Bilbao formed a significant portfolio of public funds. It is worth pointing out, however, that these funds were hardly profitable, due to the peculiar way the Franco government had of financing the public sector debt. The bank purchased obligations tactfully and little by little, built up an interesting industrial portfolio. At the end of 1948, Banco de Bilbao’s portfolio was composed 73% of public funds, 2.8% of obligations and the rest of other securities.

In 1947, the bank carried out a capital increase for 100 milli0n pesetas and continued to grow its reserves. The Finance Ministry raised its hand in 1948, with respect to the banks’ obligation to create a special reserve fund, but Banco de Bilbao, far from receiving regulatory relief, increased its reserves further as a strategy to defend its patrimony, which was showing increasing strength. One measure of the strength of Banco de Bilbao´s business is that for every 7.2 million pesetas in deposits, it had one million pesetas in own funds.

Branch office of the Banco de Bilbao in Haro

The Bilbao bank began the decade of the 1940s with total assets of 9,851,670,512 pesetas and ended it with 15,061,695,974, while the growth of its real accumulative rate was a considerable 4.8%.

The Banco de Bilbao acquired 12 banks during the 1940s. Among them were the Banca de Nieto P. Moreno of Ciudad Real, Banca Luis Pozuelo in La Laguna, Banca José Saenz Azores in Mérida, Banca Perxas y Compañía in Figueras, Banca Anacleto Carbajoso in Toro, Zamora, and Banca Aramburu Hermano of Cádiz.

Banco de Vizcaya en the 1940s

For its part, the behavior of the Banco de Vizcaya was similar to that of its neighbor. While it did have considerable internal and external difficulties, Vizcaya also posted growth rates during these difficult years, although more moderate ones. The Vizcaya bank struggled to free itself from its uncomfortable situation by stimulating loan demand and fundamentally, by acting as a broker, selling public and private securities to its clients.

Vizcaya also grew by taking advantage of certain niche markets to broaden its network of branch offices, without ignoring the capturing of funds. After a beginning marked by tight liquidity, Banco de Vizcaya improved its activity, with a good performance of its portfolio of negotiable instruments and securities.

Branch office of Banco de Vizcaya in Vitoria

Banco de Vizcaya took somewhat longer than its neighbor to show notable growth after the civil war, although it ended up producing, given its greater propension for risk to achieve growth, as shown by its more aggressive policy on loans and debtors.

Curiously, the total asset figures of Banco de Vizcaya are almost identical to those of Bilbao, both at the beginning of the decade and the end, with 9,663,917,279 pesetas and 14,322,417,440, pesetas, respectively. The growth of the real accumulative rate of Banco de Vizcaya during the 1940s was, in the end, 4%.

As for acquisitions of other banking institutions by Banco de Vizcaya, during the 1940s it bought the Crédit Lyonnais of Seville.