BBVA’s first green bond reduced carbon emissions by 275,000 tons in 2018

The green bond BBVA issued in May 2018 has helped reduce CO2 emissions by 274,609 tons since its launch in May 2018, with another 106,539 tons estimated for 2019. It also generated 558 GWh/year of renewable energy. The bank has allocated one billion euros obtained from wholesale markets to finance renewable energy and sustainable transportation projects, according to the first bond monitoring report the BBVA Group recently published.

In April 2018, BBVA published its framework for the issuing of sustainable bonds tied to the United Nations (UN) Sustainable Development Goals (SDGs) and on May 3rd of the same year, issued its first green bond in the amount of one billion euros. BBVA’s first green bond issue was the largest in the eurozone at the time.

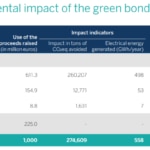

One year later, as part of the commitment made in BBVA’s framework for sustainable bond issues, the bank published its first monitoring report for this green bond. According to the report, BBVA has allocated one billion euros to finance various renewable energy and sustainable transportation projects. Specifically, it allocated €775 million to finance renewable energy projects (€611.3 million for wind energy; €154.9 million for solar energy and €8.8 million for solar and biomass energy projects) and €225 million for sustainable transportation projects.

One hundred percent of the funds from the green bond have been used for project refinancing. Of the one billion euros that were reinvested, €775 million were allocated to refinance projects that existed prior to the bond issue, and the remaining €225 million to new projects. Geographically, the U.K., Spain and France represent 87 percent of the portfolio, while 13 percent is divided among Portugal, the U.S. and Latin America.

These projects have prevented the emission of a total of 274,609 tons of CO2. BBVA’s 2019 green bond issue prevented the emission of an additional 106,539 tons of CO2 in sustainable transportation projects not included in the impact indicators (see table) as they fall outside of the reporting period (December 2018). This total number of tons of CO2 avoided would, for example, correspond to the energy consumption of more than 41,000 households or take more than 73,000 vehicles out of the road in one year or the consumption of 125 million liters of diesel, according to the methodology of the United States Environmental Protection Agency.The bond also contributed to the generation of 558 GWh/year of renewable energy.

The methodology BBVA used to calculate the CO2 emissions that were avoided thanks to the financing of green projects is based on internationally recognized standards and norms. The calculation methodology was developed by an independent advisor (ECODES), guaranteeing its impartiality and the use of objective and comparable sources. PwC also acted as an auditor to verify that project selection complies with the bank’s criteria in the sustainable bond issue framework.

This green bond is part of BBVA’s climate change and sustainable development strategy, through which the bank aims to align its business activity with the UN SDGs and the Paris Agreement. The goal is to gradually strike a balance between sustainable energy financing and investments in fossil fuels, thus contributing to the transition to a low carbon economy. Through this strategy, known as Pledge 2025, BBVA commits to mobilize 100 billion euros in green financing, sustainable infrastructure, social entrepreneurship and financial inclusion between 2018 and 2025.