BBVA to acquire a 24.9% stake in Garanti, Turkey's leading bank

BBVA announced today the acquisition of a 24.9% stake in Turkiye Garanti Bankasi, Turkey’s leading bank. The transaction is valued at €4.2 billion, 8.0 Turkish Lira per share, and it represents a 10% discount to last week’s Garanti average closing price. BBVA has also reached a shareholders’ agreement with Dogus Group–reference shareholder in Garanti, also with a 24.9% stake–to jointly manage the bank.

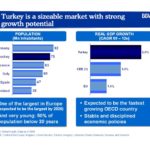

The deal, which creates value for shareholders from the beginning, allows the BBVA Group to enter Turkey, one of the emerging markets with the highest growth potential. Estimates point to a 5% average growth for Turkey’s GDP between 2009 and 2012.

Amid these conditions of growth and expansion, BBVA is to implement a €5billion capital increase through preferred subscription rights to the group’s current shareholders. The capital increase will have a subscription price of €6.75 per share, which represents a discount of 29% to Friday’s closing price.

In order to reach a 24.9% stake in Garanti, BBVA is to acquire an 18.6% stake from General Electric and another 6.3% stake from Dogus Group. BBVA and Dogus will thus control identical stakes in the Turkish bank, allowing them to jointly manage the institution. According to the terms of the agreement–which has been notified to Spanish and Turkish regulators and is still pending of mandatory approvals–Garanti’s Board of Directors will be comprised of four representatives from BBVA, four from Dogus Group, and a CEO appointed by common consent.

Under this structure, any decisions from the Board will require the approval of both BBVA and Dogus. The agreement also envisages a later phase, five years into the accord, which will allow BBVA to appoint two thirds of the Board members.

Garanti will continue to have a main Turkish shareholder in Dogus–a conglomerate with more than 100 companies and 28,000 employees, with businesses in areas such as automotive, tourism, energy, construction, etc–and also a new strategic and global shareholder in BBVA, with extensive experience in developing this kind of alliances in high-growth markets. A leading bank

Garanti is Turkey’s leading banking franchise. It has 9.5 million clients, a network of 837 branches, and total assets exceeding €60 billion. Garanti is the number one bank in loans, with a market share of 13.6%, and ranks third in deposits (12.4%).

It is also the country’s main credit card issuer (market share of 17.7%). Garanti also boasts the best technological platform in Turkey, ranking first in online banking, with a market share of 37%. During the first half of 2010, Garanti posted net profit of 2.06 billion Turkish Lira (€1.04 billion), up 41.5% compared to the same period a year earlier. In 2009, Garanti’s net income was €1.55 billion.

“BBVA wants to be in markets with the highest-growth potential and Turkey, with a leading bank such as Garanti, is undoubtedly one of them,” BBVA Chairman Francisco González said. “We are very satisfied because Garanti is a very solid institution, showing throughout the years its strong capacity for development and profitability,” Francisco González added. “We also share with our new partners, Dogus Group, a common vision regarding the future evolution of financial institutions: a recurrent customer-centric business model, a prudent management of the balance sheet and liquidity, and an on-going technological effort.”

Amid these conditions of growth and expansion, BBVA is to implement a €5billion capital increase with preferred subscription rights. The capital increase will have a subscription price of €6.75 per share, which represents a discount of 29% to BBVA Friday’s closing price. BBVA shareholders will receive one new share for every five shares they hold.

The total number of shares to be issued have been underwritten pursuant to an underwriting agreement entered into by BBVA (as Issuer, Joint Global Coordinator and Agent) with Morgan Stanley & Co International PLC and Goldman Sachs International (as Joint Global Coordinators and Joint Bookrunners) and Citigroup Global Markets Limited, Credit Suisse Securities (Europe) Limited, J.P. Morgan Securities LTD, Nomura International PLC, Société Générale and UBS Limited (as Joint Bookrunners).

Once the securities prospectus related to the subscription offer is ratified by the Spanish regulator Comisión Nacional del Mercado de Valores (CNMV), the subscription period will be 15 days minimum.

“THIS PRESS RELEASE IS NOT FOR DISTRIBUTION INTO THE UNITED STATES. THIS PRESS RELEASE IS NOT AN OFFER FOR SALE OF THE SECURITIES IN THE UNITED STATES, AND THE SECURITIES MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR AN EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED. ANY PUBLIC OFFERING OF THE SECURITIES IN THE UNITED STATES WILL BE MADE BY MEANS OF A PROSPECTUS CONTAINING DETAILED INFORMATION REGARDING BANCO BILBAO VIZCAYA ARGENTARIA, S.A. (“BBVA”) AND BBVA’S MANAGEMENT, INCLUDING FINANCIAL STATEMENTS. SUCH PROSPECTUS WILL BE MADE AVAILABLE THROUGH BBVA. BBVA INTENDS TO REGISTER THE OFFERING IN THE UNITED STATES.”