BBVA Research: South America to recover in 2017, after four years of economic slowdown

South America’s GDP will recover in 2017 after four years of economic slowdown, while Mexico will bear the impact of the uncertainty surrounding US policies, which is likely to hinder its growth prospects. These are the key conclusions of BBVA Research's Latin America Outlook Q1 2017 report.

“In 2017 we expect to see certain divergence between in South America’s performance, on the one hand, and Mexico’s performance, on the other,” explained Juan Ruiz, BBVA Research’s chief economist for South America. “In both cases we anticipate a growth of 1% in 2017, but in the case of South America this rate will represent a turning point, after four years of slowdown, between 2013 and 2016, and last year’s drop in activity.”

However, explained Juan Ruiz, in the case of Mexico, the 1% GDP growth rate in 2017 represents an economic slowdown, mainly driven by the uncertainty surrounding the economic policies that will be implemented in the U.S. after the arrival of the new Government to the White House.

"In 2017 we expect to see certain divergence between in South America’s performance, on the one hand, and Mexico’s performance, on the other

Global environment: More growth and more inflation

These forecasts are made in a global scenario that started improving in the closing months of 2016 and will continue doing so in 2017. According to BBVA Research estimates global growth will increase slightly in 2017, to 3.2%, thanks to rising confidence levels across the world’s largest economies, improving indicators in the industrial sector and an incipient recovery in world trade.

However, despite the positive outlook, in its report, BBVA Research points out that 2017 and 2018 will be years plagued by uncertainty; mainly in connection with the economic policy of the new US administration, and especially the protectionist measures that are being discussed, and which are likely to cause serious damages to international trade.

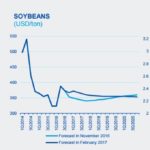

"The magnitude of the inflationary pressure is another source of global uncertainty," the report said. Spiking commodity prices, the size of the balance sheets of central banks in developed countries and fiscal stimuli prospects are three of the factors that have helped dispel the deflationary risks that loomed over the global economy only a few months ago.

"The magnitude of the inflationary pressure is another source of global uncertainty

These risks translated into high levels of volatility in Latin American financial markets. From early November through mid-December, Latin American financial assets - especially Mexican – were dragged down by rising uncertainty surrounding U.S. economic policy in the aftermath of the November 8 presidential elections and, to a lesser extent, by the Fed’s interest rate hike of December 14. However, after the initial shock, the region’s markets – except Mexico – calmed down and offset the losses they suffered in early November.

BBVA Research

Mexico: uncertainty surrounding US economic policies

Confidence indicators in Mexico dropped sharply in December and January, as a result of the uncertainty surrounding the economic policies of the new U.S. administration.

Business confidence decreased due to a series of measures that could have a negative impact on the Mexican economy. This is the case of an eventual renegotiation of the North American Free-Trade Agreement (NAFTA), the possible restrictions to migratory and remittance flows or the taxation reform plans that could result in higher tariffs levied on imports.

In the case of the families, another element that had a profound impact was the rise in gas prices and the resulting spike in inflation.

BBVA Research expects Mexico to grow 1% in 2017 and 1.8% in 2018, compared to the 2% growth rate of 2016. “The uncertainty surrounding US economic policies will hinder investment activity, while the peso’s depreciation and the resulting spike in inflation will force economic authorities to implement more restrictive monetary policies, with a negative impact on growth,” said BBVA’s research service.

"The peso’s depreciation and the resulting spike in inflation will force Mexican economic authorities to implement more restrictive monetary policies

South America: a change in trend

In South America, most confidence indicators remain unfazed after the first announcements issued by the US administration, and financial markets have calmed down. This behavior should reflect in the economic activity, translating into growth rates of 1% in 2017 and 1.7% in 2018, "thus signaling the end of the slowdown cycle that dragged down growth in the region over the past four years, between 2013 and 2016,” says Juan Ruiz.

Growth in the region will be bolstered by foreign trade balances, driven by rising commodity prices and the currency depreciations that have taken place over the past two years, as well as the boost provided by public and private investment trends in countries such as Argentina, Colombia and Peru. In terms of GDP growth, the most dynamic economies in the region will be Peru (+3.5%), Paraguay (+2.9%), Argentina (+2.8%) and Colombia (+2.4%), and, to a lesser extent, Chile (+1.6%) and Uruguay (+1.3%). Brazil, the biggest economy in the region, is also on the way to recovery thanks to the approval of the tax reform and the drop in interest rates. BBVA Research expects the country to grow by 0.9% in 2017 and 1.2% in 2018.

BBVA Research

Interest rate cuts in South America

According to BBVA Research estimates, inflation in South America will continue to decline, converging towards central bank target levels, thus paving the way for cuts in official interest rates. In Mexico, however, inflation increased significantly in the past seven months, reaching 4.6% in January, for the first time above the central bank's tolerance band since 2014. According to the report, inflation could reach 6% in 2017 as a result of the Mexican currency’s depreciation, driving Mexico’s Central Bank to raise interest rates.

Domestic and Foreign Risks

The report concludes focusing on the risks that may affect growth in the region, dividing them into two categories, domestic and foreign. On the internal side, BBVA Research highlights the risks related with the political noise in many countries, magnified by an extremely busy electoral cycle in the region, with important elections in 2017 or 2018 in almost all countries.

Also, delays in key infrastructure works in some countries could deal a blow to both internal demand and business confidence indices. On the external side, risks are mainly the result of the uncertainty surrounding the economic policies that the new U.S. administration will end up implementing (especially, but not exclusively, the risk of protectionism), as well as the macroeconomic imbalance reduction process in China, which may have a significant impact on the country’s growth rates.