BBVA Research downgrades growth forecasts for Spain to account for the impact of the invasion of Ukraine

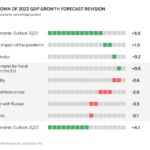

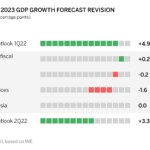

BBVA's research unit revised its Spanish GDP growth forecasts downward to 4.1% in 2022 and 3.3% in 2023 (from 5.5% and 4.9% previously). The downgrade takes account of the impact of the invasion of Ukraine, the sanctions imposed on the Russian economy, and steeply rising prices—especially for fuel and electricity—over the past few months, as indicated in the latest 'Spain Economic Outlook' report presented by Jorge Sicilia, Director of BBVA Research and BBVA Chief Economist, Rafael Doménech, Head of Economic Analysis, and Miguel Cardoso, Chief Economist for Spain.

Private consumption may see its slowdown mitigated by the easing of pandemic-related restrictions and the release of savings amassed during the lockdown. BBVA experts believe expansionary demand-side policies will support spending growth but will also put upward pressure on prices. Health risks associated with the pandemic are decreasing, but risks surrounding the geopolitical juncture, supply chain bottlenecks and inflation are on the rise.

According to BBVA Research, the effects of Russia's invasion of Ukraine will be conveyed to the Spanish economy through a variety of channels, although any impact through direct relations with the two belligerents will be limited. First, the war will lead to decreased demand for goods and services from Russia and Ukraine, while the sanctions imposed on Russia by the European Union will severely restrict trade relations with that country. However, BBVA research unit economists point out that Spanish exports to Russia and Ukraine are modest, while foreign direct investment in Spain by Russian and Ukrainian individuals and companies and the weight of Russian visitors in Spanish tourism are also limited. The exposure of the Spanish financial system to the economies of these two countries is likewise very low.

Instead, the factor with the highest impact on the Spanish economy will be the spike in commodity prices in countries where Russia and Ukraine have a large market share. BBVA Research experts highlight coal and oil: Russia's prominence in the world fuel supply and the effect of the sanctions, will, the BBVA economists believe, trigger a relative shortage that will feed through to gasoline and gas prices. With regard to gas, the report points out that Spain is in a better position than other EU member states to face the consequences of a shortage. The analysts rule out gas supply cuts or usage restrictions in Spain, unlike what could happen in other European countries. However, BBVA Research expects gas prices to be historically high and to affect electricity spending and hurt the most power-intensive businesses, even if the European Commission greenlights the Spanish and Portuguese governments' proposed price caps. Specifically, BBVA Research forecasts that higher gas and oil prices will subtract 2 pp from Spain’s GDP in 2022 and 1.7 pp from GDP in 2023.

In addition, BBVA Research expects production chain disruptions to continue, not only as a result of the war in Ukraine but also of other factors, such as China's "zero tolerance" policy on COVID-19, volatility in the commodities market and rising energy costs. Furthermore, inflation is curtailing household purchasing power, which will hurt consumption. Finally, declining confidence could have adverse consequences for investment and consumption.

Against this backdrop, BBVA Research has revised its forecast for European GDP growth in 2022 downward from 3.7% to 2.0%, and, for 2023, down from 2.7% to 1.8%, while predicting an asymmetrical impact within the continent. The BBVA economists expect the EU-wide drop in GDP growth to be passed on in the same proportion to Spain's GDP performance. All these factors combined lead to a downward revision of GDP growth forecasts for Spain to 4.1% in 2022 and 3.3% in 2023.

Spain's GDP grew by close to 1.4% in the first quarter of 2022

Available data shows that in the first three months of the year Spanish GDP moved off the starting line with a growth rate of around 1.4%. Consumption picked up, while faster disbursement of NGEU funds seemed to be feeding through to the economy.

According to the report, the indicators available since the invasion of Ukraine and the announcement of sanctions point to an adverse—though still limited—impact on activity in Spain. During the second half of March there could be a certain slowdown in credit card spending, for instance, due to inflation, with card usage focusing to a greater extent on transportation and food purchases. Nonetheless, home purchases continue to increase, driven by changes in household preferences, the release of pent-up savings and inflation. In addition, spending supported by NGEU funds has accelerated: in BBVA Research's view, this will reinforce the transition toward investment-led growth.

Regarding monetary policy, BBVA Research economists believe it will remain expansionary, although a gradual normalization of interest rates is expected to begin. The analysts thus predict that the ECB will begin to raise rates toward the end of the year or early next year, once uncertainty clears around GDP performance and availability of gas. Furthermore, the BBVA economists expect the European Central Bank (ECB) to end its Asset Purchase Program (APP) in the coming months.

With regard to risks, the report warns of the high uncertainty in the current context. According to BBVA Research, inflation has become the main threat to a robust recovery of the Spanish economy. Inflation, on average, could end 2022 at 7% and 2023 at 2.5%, although it may ease this year if the European Commission approves the Spanish and Portuguese governments’ proposals to cap the price of electricity. The BBVA analysts also point to the uncertainty surrounding the pace of award and disbursement of NGEU funds and their impact.