BBVA recognised as a world leader in open banking

BBVA has again been named as one of the world's leading financial institutions when it comes to open banking. The accolade comes as part of the Open Banking Report 2019, published by online banking experts The Paypers and Innopay. The authors of the report also interviewed BBVA’s Global Head of Open Banking, Carlos López Moctezuma, drawing on his insights to explain best practice in the sector around the core themes.

The term open banking often refers to a system that provides users with a network of financial institutions’ data using application programming interfaces (APIs). By opening APIs to sharing, third parties have easier access to financial information, which allows them to build new and different apps and services.

BBVA has helped spearhead this change in approach –often explained as from closed to open–as the bank firmly believes that it is in consumers best interests for data to be shared, and in doing so, to encourage innovation and evolution.

In fact, the bank’s Chairman, Carlos Torres Vila, has been vocal in calling for a global regulation around data sharing, across industries, geographies and regulatory regimes, to ensure that the data consumers generate online is able to be shared with their consent more widely to support the growth of the wider digital economy.

This latest Open Banking report –published by The Paypers and Innopay and available here– testifies to the potential power of both open banking and data sharing, examining how the change in approach will lead to new business models, payment propositions and services, benefitting both businesses and consumers alike. Outlining its remit the reports authors state that their intention is to shine a light on how the open banking drive globally has shifted and developed and the trends that are being seen, all with a view to the impact the paradigm shift could have on the sector.

The authors add: “It builds on the previous report and expands on topics such as trust, consent, and improving customer experience, while not forgetting the importance of collaboration between banks and fintechs, along with its obvious benefits.”

"BBVA’s open banking aims to reach other platforms where its clients are already operating”

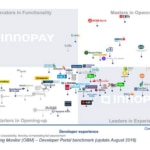

One area especially called out for praise in relation to this was BBVA’s developer experience, with the analysts from Innopay citing BBVA alongside Scandanavian banking group Nordea, Deutsche Bank and Capital One as the world leaders.

Innopay’s assessment model consists of, amongst other things, its Open Banking Monitor report, which assesses how banks are opening up their processes via APIs to third parties, in part in Europe at least, in response to PSD2 (Payment Services Directive 2).

The report notes that the majority of banks analysed consists of E.U. banks mandated to open up their APIs –with more than 250 banks within the E.U. regulatory regime area having launched open banking API functionality pertaining to areas like payments, account information sharing and confirmation of available funds.

However the report adds that –with a few exceptions including BBVA– most of these 250 E.U. banks scored fairly lowly in the rankings as they really only did the minimum required as per PSD2, as opposed to banks that had truly embraced open banking.

In an interview in the report, Carlos López-Moctezuma, BBVA’s Global Head of Open Banking, said BBVA’s adoption of open banking principles stemmed from several ideas. Firstly, that digitisation was exponentially transforming every business sector, with one of the critical shifts being the control it increasingly gave consumers and businesses over where, how and with whom they used as service providers.

López-Moctezuma said: “This ongoing change in consumers marks the present and future of Open Banking: users wish to easily access a range of customised services, seamlessly, and in real time. Against this new backdrop, BBVA’s Open Banking aims to reach other platforms where its clients are already operating.”

He added that the recently launched partnership between BBVA and Uber in Mexico to launch banking products on the Uber platform was a great example of open banking in action. He said: “Uber’s driver-partners and delivery partners can now create a digital account linked to the international debit card ‘Tarjeta Socio Conductor’, using Uber’s app without having to access the bank’s App.”

“With this new service, Uber’s driver-partners can receive their income directly in just a few minutes, and access a platform for financial benefits, such as loans, as well as non-financial benefits, including discounts and refunds for purchases at gas stations with the new card,” he added. He concluded that while vigilance around cyber security remained at the top of the priority list when it comes to opening up banking platforms, the opportunities the shift from closed to open will bring for consumers and businesses alike mean this was a watershed moment for banking.