BBVA Microfinance Foundation, largest global contributor to gender equality initiatives

Sandra Ceballos is a single mother who besides tending to the needs of her four children, also takes care of the environment through her recycling business. Jessica Quipainao, also the primary breadwinner in her household, preserves her Mapuche heritage by making jewelry. Johana Jurado sells garments to leave a legacy for her daughter, and therefore strives to keep this small business afloat. They are just three of the 1.5 million women entrepreneurs across five Latin American countries that are thriving with help from the BBVA Microfinance Foundation (BBVAMF). Thanks to this work and its development finance initiatives, the Foundation is the top contributor to gender equality, according to the latest report by the Organisation for Economic Cooperation and Development (OECD).

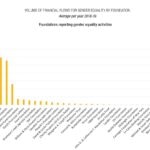

The report, entitled 'Development finance for gender equality and women’s empowerment: A 2021 snapshot', is based on the data and figures reported by countries, multilateral organizations and private foundations regarding their efforts to foster women’s empowerment in 2018 and 2019. Over the course of these two years, the Foundation, through its microfinance institutions (MFIs) disbursed, on a yearly average, 595 million dollars to address three basic needs of the most vulnerable women in the region: economic independence, self-esteem and sense of belonging and social integration. The OECD notes that, to close the gender gap and meet the 2030 Agenda goals, the public and private sectors must significantly and consistently increase their investment, and even more so now due to the COVID-19 pandemic.

Source: OECD

Aware of this need, BBVAMF has remained true to the commitment it made when it was first created, to support women entrepreneurs in vulnerable situations, who generally start with fewer resources, and more limited access to basic services and training. To help these women succeed - who represent 60 percent the entrepreneurs it supports in the region - the BBVAMF not only offers specific financial products and services (for example, health microinsurance, loans for rural women and farmers, or access to communal banks for the most vulnerable), but also provides them with the financial education and skills training they need to help them grow their businesses and income.

“During the course of these years, we realize that many women start businesses out of necessity and that they’re not only good at managing them, but that they also invest better and spend wiser. They allot 90 percent of their income to health, skill building and their children’s education,” said BBVA Microfinance Foundation’s CEO Javier M. Flores.

As Sandra, Jessica and Johana prove day after day, women are true catalysts for the progress of a country, even a region, thanks to their important contribution to the development of their families and communities, an essential endeavor to foster sustainable and inclusive growth and reduce poverty. Moreover, prior COVID-19, according to estimates, ensuring full and equal participation of women the GDP of Latin America would increase by 14 percent (the equivalent of adding $2.6 trillion to the economy).

Johana Jurado, Sandra Ceballos and Jessica Quipainao, entrepreneurs served by the BBVA Microfinance Foundation in Latin America

In this new context, the challenge that lies ahead is as great as the opportunity at hand to build and rebuild a better society, which promotes the talent of all people based on access to equal opportunities. Through microfinance and together with its partners, the BBVAMF will continue working for the woman entrepreneur, the true driver of a change that is as necessary as it is urgent.