BBVA Management, including Chairman and CEO, waive their 2020 variable remuneration

BBVA Chairman Carlos Torres Vila and CEO Onur Genç will not collect their variable remuneration for 2020 as a gesture of responsibility in a year marked by the COVID-19 pandemic, as detailed in the annual remuneration report for BBVA directors. The decision is also a sign of their commitment to their customers, shareholders, employees and society as a whole. Additionally, the bank has updated its remuneration policy for the next three years (2021, 2022 and 2023), which will be presented for approval at the Annual General Meeting.

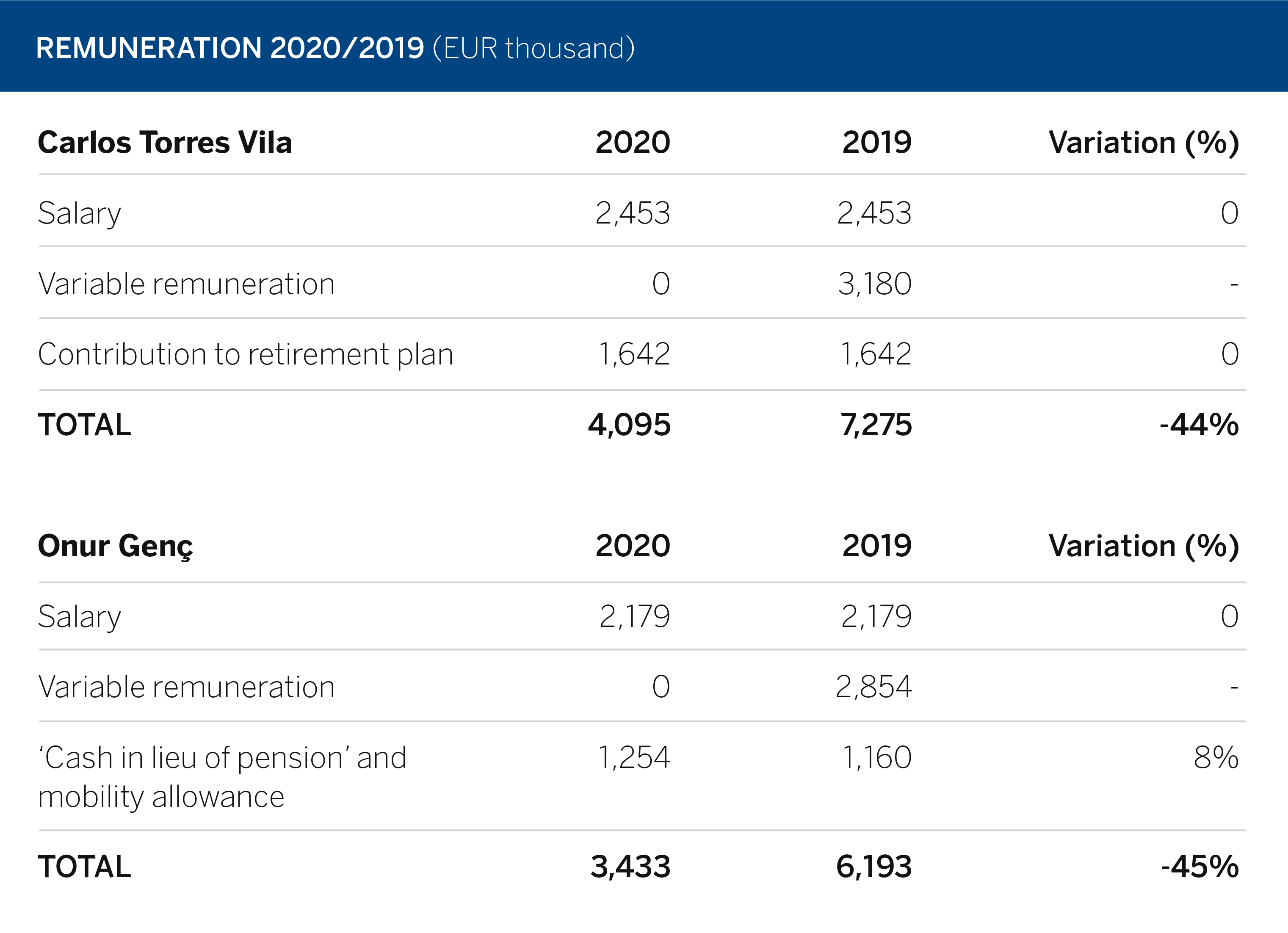

A total of 330 BBVA employees, which includes the Chairman, the CEO and other executives running the bank on a global level and in the different countries, have voluntarily waived, in total or in part, their variable remuneration for 2020. The decision represents a 44 percent reduction in the Chairman’s total remuneration for the year, and a 45 percent reduction for the CEO.

In 2020 Carlos Torres Vila earned the same salary (€2.453 million) as a year earlier, while he waived all his annual variable remuneration. The annual contribution for his retirement plan was €1.642 million (set in 2017). Including all these concepts, the Chairman’s total remuneration for 2020 was €4.095 million, down 44 percent from a year earlier. Additionally, the bank covered €377,000 in insurance premiums for death and disability, and €228,000 in remuneration in kind.

As for the CEO, Onur Genç earned the same salary (€2.179 million) as the previous year, and also waived his 2020 variable remuneration. He gets a complementary payment (‘cash in lieu of pension’) on his fixed salary and a mobility allowance given his condition of high-ranked international executive. For these two concepts he received €1.254 million. His total remuneration for 2020 was €3.433 million, down 45 percent compared to 2019. Additionally, the bank covered €253,000 in insurance premiums for death and disability. His remuneration in kind was €132,000.

New remuneration policy

BBVA has updated its directors remuneration policy, following regulatory changes regarding remuneration that are expected to come into force in 2021, and the advances in the adoption of best practices in the market. The bank will present this policy at the next Annual General Meeting for its approval. If approved, it will be applicable for 2021, 2022 and 2023.

The proposal makes progress in including modifications from the Good Governance Code of Listed Companies, which was issued by Spanish regulator CNMV, and revised in June 2020. Furthermore it considers SRD II, CRD V and Guides produced by the European Banking Authority.

Main developments of the Remuneration Policy for Board Members include:

- Explicit incorporation of the principle of equal pay for men and women.

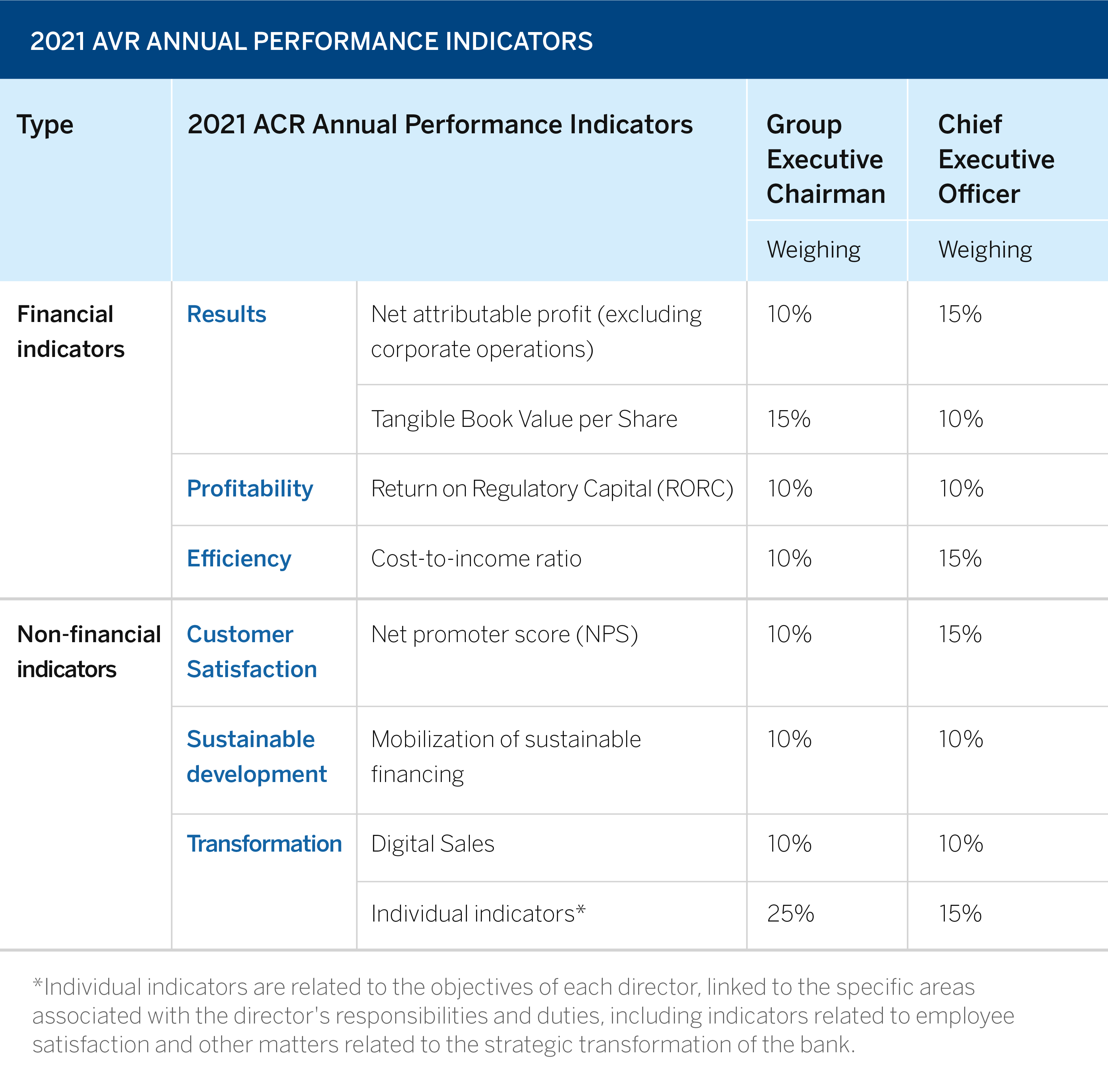

- Incorporation of sustainability metrics as part of the variable remuneration scheme for executive board members.

- Changes to the payment schedule for the deferred portions of the annual variable remuneration of executive board members.

- Transformation of the retirement plan for the Chairman, which will modify the amounts of his remuneration and will reduce his total compensation.

- Changes to the malus (reduction) and clawback (payment recovery) clauses of the annual variable remuneration of the executive board members.

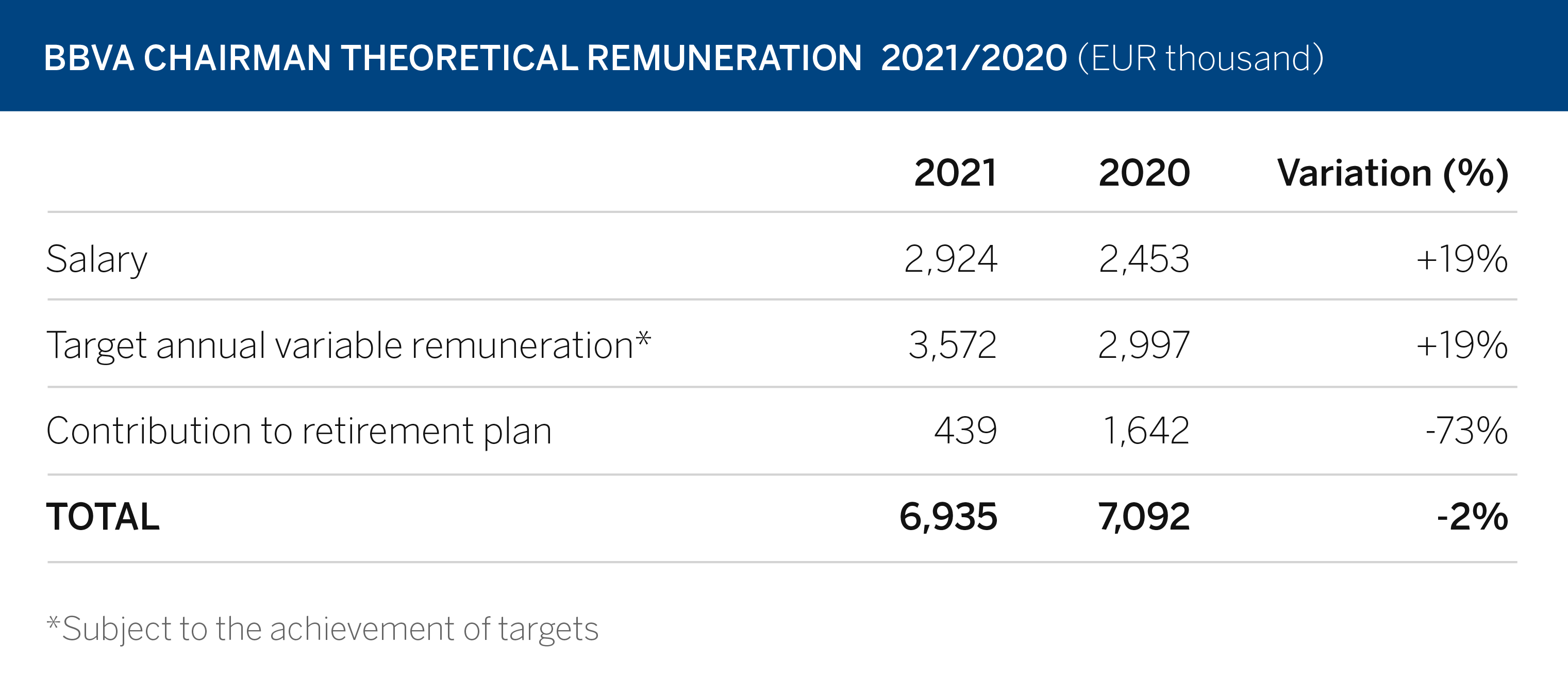

The policy includes a modification in the retirement plan for the Chairman in order to align it with the best market practices at international level, while also securing continuity to the changes carried out in 2015 and 2017. At this time, it proposes to significantly reduce the annual contributions of his retirement, which will change from €1.642 million (about 67 percent of its salary) to €439,000 (15 percent of its annual salary, in line with the retirement contributions for the rest of Senior Management executives). The difference of both figures will be distributed between his salary and his target variable remuneration, keeping the current weighing of these two components (45 and 55 percent, respectively), except for the annual amount of €157,000 that the Chairman is waiving. This represents a reduction of 25 percent in the amount included in his annual salary. Therefore his total remuneration (fixed, variable and retirement plan) will be reduced by 2 percent with this modification. Additionally, coverage levels in case of death of disability of the Chairman are also reduced significantly.

The Chairman’s fixed remuneration will be €2.924 million and that of the CEO will remain unchanged at €2.179 million. The target variable remuneration (representing the bonus amount in case of a 100% fulfillment of agreed goals) has been set at €3.572 million for the Chairman and it remains at €2.672 million for the CEO. The variable remuneration payment will continue to depend on achieving the agreed goals in each fiscal year according to a series of financial and non-financial indicators. As part of a change among non-financial indicators, a new indicator of mobilization of sustainable financing is created for 2021. This will have a weighing of 10 percent in the variable remuneration of the executive board members.

Finally, a series of changes have been made to the payment schedule of the deferred portions of the annual variable remuneration of executive directors (a maximum of 60 percent of said remuneration), in line with accepted market practices, which will now be distributed in five years (a 20 percent per year). There are also changes to the malus and clawback clauses to reflect a new condition for the application of reduction and recovery mechanisms of the variable remuneration in case of relevant reputational harm to the bank. Additionally, this policy answers and organizes certain concepts in order to achieve more clarity and technical precision.