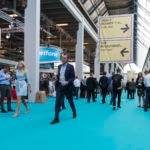

BBVA hosts an informal startup networking session at Money20/20 in Copenhagen

More than 200 startups came along to the event, which was aimed purely at giving businesses from a huge array of different backgrounds the chance to meet and better understand each other.

The focus of Money 20/20 is on Fintech and the technologies that will shape the future of both customer and corporate banking in the future.

One of the areas most represented at last night's BBVA event was security, which has been a key theme across the entire three days event.

Identity security and new ways of authentication are one area the start-up community is bringing to the market, including biometric face recognition and smart light detection.

Equally cyber security and fraud prevention were high on the agenda, with dozens of business working on new solutions to spot crimes taking place and act before any money or data is taken.

In relation to that, and also a very prominent topic, there were a number of start ups working to protect customers and banks in the lead up to the PSD2 regulations coming into force. These solutions ranged from real-time banking platforms for corporate customers, where they could see their financial accounts and all the businesses plugged into them through APIs, to entire core banking platform built specifically for open banking requirements.

Another key area was that of mobile platforms, again with a lot of solutions focused on protecting user data and security, but also looking at integrated AI advisors built into mobile apps.

Money 20/20 will play host to Open Talent Artificial Intelligence final.

The last major area where startups were engaged centred around payment services and new ways for making and tracking payments, including mobile and voice activated, cross border payments and transactions that could be hedged in real time to mitigate against currency fluctuations.

Commenting on the event BBVA'S Head of Open Innovation, Marisol Menendez, said: "It's was a great event, and we have learned so much from getting to know the startups here tonight and what is driving them.

"While banks like BBVA are good at innovating, the startup sector looks far wider at the ecosystem and brings to the industry the kind of creativity and excellent user experience that customers and clients really demand in this digital age.

"We get a great understanding of the future technologies that will change this industry by working with startups, and equally they get a lot of value from talking and partnering with a bank the size of BBVA."