BBVA Francés: from traditional bank to powerhouse digital bank of the new millennium

The oldest private domestic bank in Argentina and one of the leaders in Latin America, BBVA Francés on October 14 marked its 130th year in operation and its 21st year as part of the BBVA Group. In the course of its history, BBVA Francés has gone from being a 20th century “temple of money,” to a powerhouse of digital banking in the Argentina of the 21st century.

The story of BBVA Francés could be laid out in a graphic sequence similar to Darwin´s theory of natural selection, an evolution marked by a series of milestones.

The point of departure was the year 1886, when BBVA Francés was incorporated as a private company according to the laws of the Republic of Argentina. Thirty-nine years passed before the architect Jorge Bunge designed the headquarters building decorated with pillars crowned by Corinthian capitals. It was conceived as a French manor house, but with a majestic aspect that caused one observer to describe it as a “temple of money.”

The building was finished in 1926. - BBVA

One year later, BBVA Francés closed the circle of banking tradition when it merged with Banco de Crédito Argentino, whose headquarters stood on the other side of the Plaza de Mayo in Buenos Aires.

The sumptuous, Renaissance style that reigns in Latin American banks is reflected in those pillars that support the BBVA Francés headquarters. But everything changes, and BBVA Francés now occupies a modern corporate headquarters, a giant in this Darwinian evolution of the species. In this ultramodern glass and steel tower in the Retiro neighborhood, the watchword is digital transformation.

BBVA Francés is a universal bank with a nationwide presence in Argentina, through 251 branch offices, 776 ATMS, 820 ATSs and 6,142 employees. Currently, the bank has 2.4 million retail customers and 42,701 business clients, in addition to 838 large corporations that are serviced by the Corporate & Investment Banking (C&IB) department.

BBVA Francés is the oldest private financial entity in Argentina. - BBVA

The bank has 1.29 million active digital clients, who connect through Francés net, with an average annual increase of 28% and a market penetration of 55.2%, according to October, 2017 figures.

Francés móvil has 578,000 active digital clients who regularly connect, with an annual increase of 37% and a market penetration of 24.7%.

Some 55% of the digital clients of BBVA Francés choose to connect with the bank exclusively through its website, while 12% do so only via mobile phone and 33%, through both channels.

BBVA Francés’ assets total $11.6 billion, an increase of 12%; the bank placed 18% more loans than last year, for a total of $6.5 billion, while net deposits fell less than 1% from 2016, to $7.5 billion.

Given the ample growth potential in the Argentine banking sector, opportunities are present in the mortgage market, which is undeveloped, as well as in energy and infrastructure, which were without investment for 15 years.

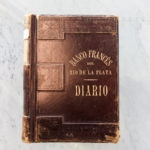

Diary of Banco Francés del Río de la Plata, year 1886.

It should be noted that there is also a potential for rapid bank penetration, given the low ratio of loans/GDP and the improvement of the economy. BBVA Francés has a diversified business model, based on a muti-channel platform, alliances and strategic sponsorships. Among these, of note are the alliances with Latam Airlines and Move Concerts and the strategic sponsorships of the soccer teams Boca Juniors, River Plate and Talleres de Córdoba.

In the area of secured loans, leasing and other financial products and services associated with purchasing, maintenance and insurance of vehicles, BBVA Francés is one of the most active banks in the country. It has links to companies such as: PSA Finance Argentina Compañía Financiera; Rombo Compañía Financiera and Volkswagen Financial Services Compañía Financiera.

BBVA Seguros was founded under the name Consolidar in 1994 and became part of the BBVA Group in 1998. It operates in the segments of life, personal accident, burial, robbery, fire, home, integral and miscellaneous risk insurance.

As for the mutual funds industry, BBVA Francés Asset Management had 38.3 billion pesos under management at 30 November 2017. As a management company, it is charged with the management, administration and representation of the FBA Family of Mutual Funds, which is composed of a wide variety of funds and directed to retail and institutional investors, covering all the profiles that result from the profitability-risk equation.

BBVA Francés Valores is dedicated to the purchase and sale of negotiable securities and other instruments and authorized transactions, dealing directly with clients.

The building combines wide, open and transparent architecture typical of a high-tech construction. - BBVA

The transformation

The strategy of BBVA Francés, in the new macroeconomic context, is centered on:

- Increasing market share in a context of growth that is mainly organic, while analyzing inorganic opportunities that can add value.

- Continuing the strategy of capturing customers through partners and digital campaigns.

- Reinforcing the presence of the retail segment and certain tranches of the PYME segment.

- Strengthening the multichannel approach and digital capacity over presence at the branch network.

- Transforming customer processes and experience.

The symbol of the digital transformation of BBVA Francés materialized with the acquisition of 23 of the 33 floors of a modern tower in the Catalinas area of the Retiro neighborhood of Buenos Aires. The building complies with the most stringent international environmental and sustainability norms and is aligned with the BBVA Group´s commitment to protecting the environment.

The luminous BBVA sign stands out against the blue sky of the day and the dark of night. This real estate development was one of the largest projects in Argentina in corporate skyscrapers.