BBVA Compass economists: Even if enacted at full strength, Trump’s economic agenda would yield mixed results

During the presidential election, then-presidential-candidate Donald Trump proposed various plans aiming to boost the U.S. economy to a state of higher economic growth, high labor participation rate, low unemployment, and reduced trade deficits. Specifically, those plans asked for increasing infrastructure spending and implementing protectionist trade policies.

For our Third Quarter Economic Outlook, we examined the various impacts of these economic policies.

Infrastructure spending

Using fiscal policy to stimulate the economy has a long history since John Maynard Keynes’s General Theory permanently changed the landscape of economics. However, mainstream opinions toward its effectiveness have swung significantly during the last six decades. In 1961, the Kennedy government managed to increase defense expenditure dramatically, and the subsequent strong economic growth convinced policymakers that discretionary fiscal policies combined with expansionary monetary policies were the key to a prosperous economy. Upon repeated usage in the next two decades, though, this stimulative recipe reached its limit. A series of disastrous recessions with high inflation and unemployment in the 1970s put the discretionary fiscal policy under scrutiny.

Source: BBVA Research

The slow recovery from the Great Recession, however, has led economists and policymakers to revisit the issue as they explore more options to jumpstart the economy and reconsider the role of the fiscal policy. As the “Make America Great Again” slogan and a series of speeches reveal, President Trump and his economic advisors have looked into the past, and shown strong interests in discretionary fiscal policies such as expanding the defense budget and infrastructure investment. According to the “Rebuild America’s Infrastructure” plan released by the White House, the president “has dedicated $200 billion in his budget for infrastructure.”

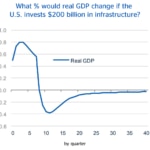

Although fiscal policy is still being negotiated, the proposed magnitude of the infrastructure plan should not be considered as completely irrelevant. Even if $200 billion in investment may seem overly aggressive, it can still help us to estimate the largest possible economic impact from the fiscal stimulus. Therefore, for the purposes of this analysis, we assume that the president convinces lawmakers and Congress approves a budget with $200 billion dedicated to infrastructure. We further assume that the extra expenditure would be spent in eight quarters at steady growth rates.

According to our analyses, the $200 billion infrastructure investment can boost real GDP growth by 0.8 percent at the peak, but the positive effect would quickly converge to zero when the fiscal stimulus program ends at the eighth quarter

According to our analyses, the $200 billion infrastructure investment can boost real GDP growth by 0.8 percent at the peak. However, the positive effect would quickly converge to zero when the fiscal stimulus program ends at the eighth quarter. The temporary effect is consistent with the experience from the 1960s in which fiscal stimulus only has a short-term effect and should not be used as a cure for structural problems. Moreover, using the Fed’s forecasting model helps to estimate the “crowd out” effect on private consumption and investment. The negative impact on their short-term growth rates is significant. Additionally, the estimated effect on inflation is also consistent with existing literature.

Protectionist trade policies

International trade has been one of the key issues in President Trump’s political agenda. In our previous discussions, we have examined the effect of Trump’s speeches and stylized facts of the trade balance. Here, we try to shed light on potential trade policies and how they would influence the economy.

Although the Trump government has had talks with leaders of other countries on trade issues, under the current rules on trade negotiations, the change of trade policies would require the collaboration of different bodies of the government. Given the highly complicated input-output structure of the U.S. economy and its sheer importance in the global economy, any trade reform would require a lengthy process of deliberation and negotiation. For example, the House Republicans’ border adjustment tax (BAT) plan has been widely criticized for generating “unintended consequences” and thus is not expected to pass.

On the other hand, even though the BAT plan no longer seems to be under consideration, the president can still use other ways to impose trade barriers that increase the costs of foreign goods and protect domestic manufacturers. For example, the investigation on imported steels is widely expected to result in higher import tariffs. As the current administration also plans to investigate other imports such as sugar and lumber, higher costs of international trade may be inevitable for the U.S.

The rising cost of international trade would have adverse effects on the economy. First, trade barriers would introduce market frictions and thus increase price markups of affected goods. Second, higher costs of international trade would also cause structural changes in the globally integrated supply chain, which reduce productivity. Given the highly complex input-output structure of the U.S. economy, we assume that more trade barriers would increase the markups of capital goods and consumption goods by one-tenth of their standard deviation, and decrease the economy-wide productivity by one-tenth of their standard deviation.

The loss of productivity caused by trade barriers would have a dominant and permanent effect on economic variables

Based on estimates from the Fed’s forecasting models, protectionist trade policies would increase the price markups in the economy, and their effect would be transitory and mostly disappear after two years. On the other hand, the loss of productivity caused by trade barriers would have a dominant and permanent effect on economic variables. This estimate is consistent with the theoretical and empirical literature on openness and productivity growth. That is, when trade barriers increase, the productivity would fall either because the less competitive firms can remain in the market, or because cheaper imported intermediate goods would become unavailable for domestic firms. Since productivity growth is incremental, the negative productivity shock would permanently damage the economy.

The mediocre economic growth since the end of the recession has been challenging economists and policymakers in both theory and practice. As many economists have suggested, headwinds are more likely to be long-lasting rather than temporary. Moreover, the key to achieving the goal of 3 percent growth is to provide a strong boost to productivity, and such increase would require a policy package that aggressively incentivizes private investment. According to our estimation, the implementation of the president’s agenda would have mixed effects on the economy. Increasing infrastructure spending by itself can only provide short-run stimulus at the cost of crowding out private investment. On the other hand, a well-thought-out plan that includes higher infrastructure spending could boost long-term productivity, and generate larger benefits than what our model predicts. Furthermore, although renegotiating out-of-date trade agreements can eliminate frictions and make the market more competitive, using protectionist policies as leverage would risk weakening productivity growth and inflicting permanent damages to the economy.