BBVA arrives in Italy with a 100% digital offering

The BBVA Group is debuting fully digital retail banking in Italy, with a unique value proposition and customer experience. BBVA is entering the Italian market with free digital banking; one of the most secure cards in the world - as there are no printed numbers on the card, and a dynamic CVV - unmatched in Italy; and financing products at competitive prices.

“Our value proposition aims to bring together the product offering and strength of a traditional bank with the customer experience of a digital player. We want to bring the best of both worlds to Italy: a universal digital bank,” said Onur Genç, BBVA's CEO.

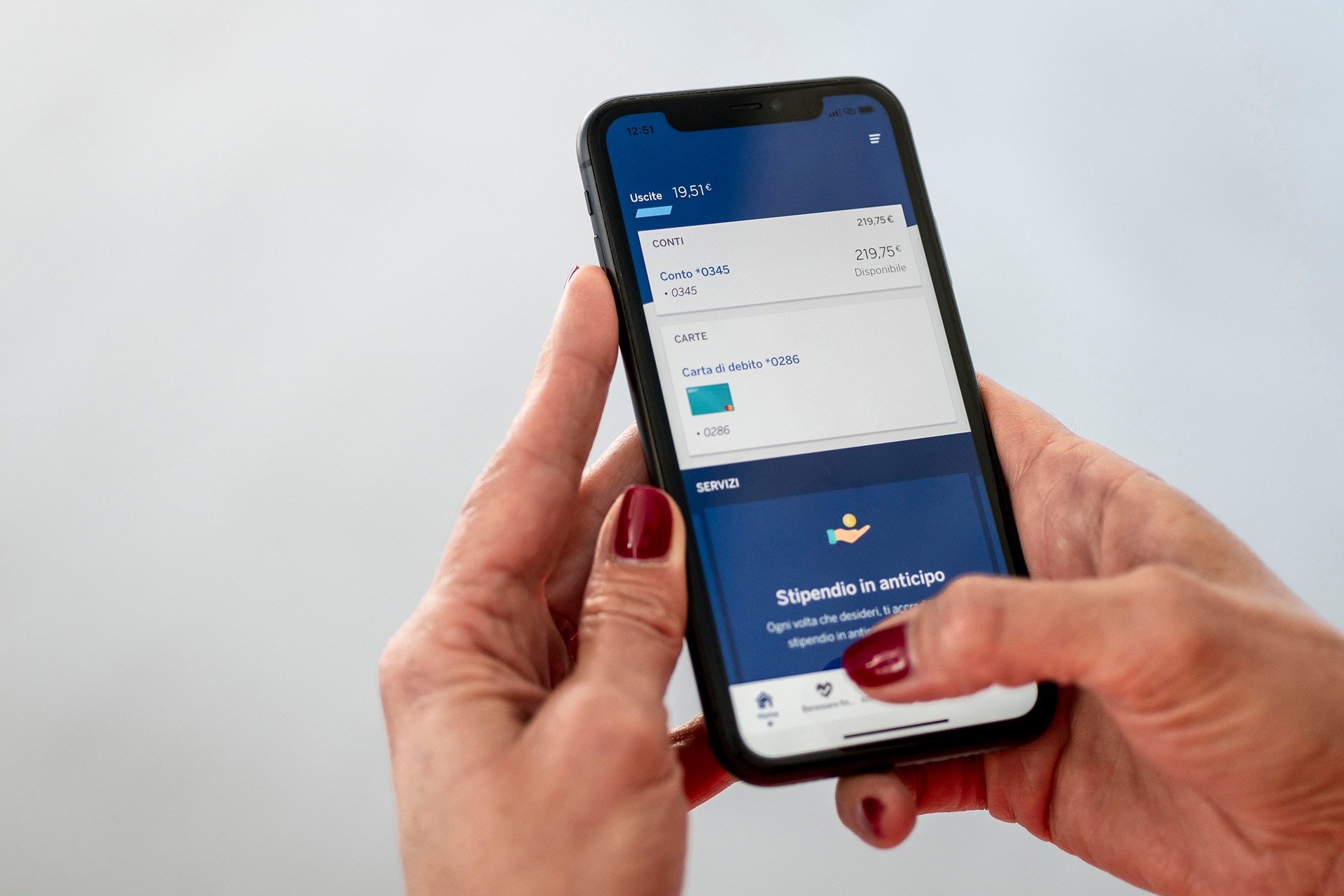

BBVA, which has been present in Italy for more than three decades through its wholesale banking business, is now going a step further and approaching the retail customer. BBVA's leadership in digitalization and the potential of its mobile banking app, recognized by Forrester for the fifth consecutive year as leader in digital experience in Europe, have been the starting point for launching this fully digital offer in Italy. Today, 38 million of the Group's customers interact with the bank through digital channels; more than 62% do so through the mobile app; and 7 out of 10 sales are made digitally.

“Italy is a large market, which is undergoing a profound digital transformation. E-commerce, the use of mobile banking and card payments have grown double digit in recent years, which provides great opportunities for growth,” adds Onur Genç.

Commission-free and with one of the safest cards on the market

The BBVA card, unique in Italy, has no printed PAN (card number) or CVV (verification code). This key is generated from the app each time the customer makes a purchase, which adds greater security to the transaction. It is a clear example of innovation in security coupled with simplicity and convenience.

The bank's Italian customers will benefit from a 24-hour-a-day, seven-day-a-week telephone and remote customer service. This is a multidisciplinary team of specialized managers, equipped with all the tools and channels to meet customers' needs.

“BBVA has arrived in Italy with the goal of being the ‘Zero Commission Everyday Mobile Bank’ of reference for our customers, with a commission-free mobile banking experience, with tools that help to save and control expenses from the app in a convenient and simple way, and with financing products geared towards everyday needs, available at the click of a button and with very simple and competitive prices,” said Javier Lipuzcoa, BBVA's head of digital banking in Italy.

The offer also includes:

- An online debit card account with no fees or commissions.

- Free transfers, including immediate transfers

- Free cash withdrawals from 100 euros at any ATM in the eurozone

- A mobile payment service with Samsung Pay, Google Play or Apple Pay

And a range of financing services at no fixed cost, adapted to the customer's spending:

- Pay&Plan, which allows you to pay for purchases up to €1,500 in instalments

- Paycheck Advance, which allows clients to receive a portion of their salary up to €1,500 in advance.