BBVA, a global brand that believes in sustainable finance to build a better world

Sustainability is a core part of BBVA's strategy. This strategy encompasses the bank’s Pledge 2025, which is founded on three pillars: 1) to secure €100 billion for green financing, sustainable infrastructure projects, social entrepreneurship, and financial inclusion. In the 18 months prior to and through June 2019, the bank had already secured €22 billion, close to 20 percent of its goal; 2) to manage environmental and social risks in order to mitigate direct and indirect impacts. BBVA will place an internal price on its CO2 emissions, which will be factored into its decision-making processes. All this will contribute to the bank's goal of being carbon neutral in 2020; and 3) to engage with all stakeholders in order to collectively advocate for sustainable development within the financial industry. In 2019, the bank spearheaded the initiative that resulted in the Principles for Responsible Banking, and it signed up to the banking sector's Collective Commitment to Climate Action.

2019

- BBVA passes 50 percent mobile tipping point

- BBVA is the overall leader in mobile banking for the third year in succession

- BBVA deploys its new brand identity worldwide

- BBVA revolutionizes the corporate loans market with a new digital loan

- BBVA, in alliance with Uber, launches first banking product in Mexico that operates in third party app

- BBVA signs UN Principles for Responsible Banking

- BBVA signs the Collective Commitment for Climate Action

- BBVA will offer digital customer onboarding everywhere it operates by the end of 2019

- BBVA doubles down on its data push with the creation of the AI Factory

- BBVA presents employees a new plan for productivity and work-life balance

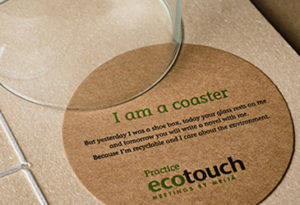

- BBVA’s sustainable solutions for a green future

- Carlos Torres Vila: “Sustainability is a core part of our strategy”

BBVA also clinched its position as the leader of transformation in the finance sector: in 2019, more than half of BBVA’s customers use mobile devices to interact with the bank. The BBVA app in Spain has set the standard worldwide for mobile banking (singled out by Forrester Research as the best banking app in the world for three consecutive years.) Digital sales continue to grow: in the third quarter of 2019, they represented 59 percent of all units sold, whereas two years ago, they only made up 33 percent of the total.

In a complex macroeconomic landscape with low or negative interest rates in developed markets and a general cooling of the world economy, BBVA’s share performance has set it apart from the rest of the Spanish finance sector. The bank's results released through September exceeded analyst consensus forecasts, and it has continued to create shareholder value: the tangible book value per share plus dividends paid in the first nine months of the year reached €6.51 (+14.2 percent YOY). All of this results from a diversified business model and recurring revenues with little volatility.

A positive trend in operating expenses and the growth of recurring revenues have fed into an improved efficiency ratio (48.7 percent at the close of September, 75 basis points below the 2018 figure, in constant terms). This ratio remains significantly below the average of BBVA’s European peers (63.6 percent according to September 2019 data).

BBVA announced double digit profitability (Return on Tangible Equity or ROTE of 12.2 percent), much greater than the average for comparable European financial institutions (7.0 percent); and a Return on Equity (ROE) of 10.1 percent (compared to the 5.9 percent average through September for the bank’s European peers).

The fully loaded CET1 capital ratio stood at 11.56 percent at the end of September, well within the bank’s target range of between 11.5 and 12 percent, thanks to the Group's internal capital generation capacity (22 basis points so far this year, after absorbing 24 basis points from regulatory impacts).

Strength of credit quality indicators: The coverage ratio stood at 75 percent at the end of September, the non-performing loan (NPL) ratio at 3.9 percent, and the cumulative cost of risk at 1.01 percent.

Climate change, the crisis of biodiversity and inequality are the major sustainability challenges for BBVA. Therefore, the commitment in our identity is reflected in the signature of the Principles of Responsible Banking.

Do you know what the SDGs are?

This new international strategy is the key to the development programs that will be designed over the coming years, pushing states to mobilize the resources needed for implementation of the SDGs and to achieve partnerships between the public and private spheres. BBVA demonstrates its commitment to the 17 Sustainable Development Goals.

Carlos Torres Vila: “Our goal is for all BBVA products to offer a sustainable option”

A real commitment

In February 2019, BBVA announced its climate change and sustainable development strategy to contribute to achieving the SDGs. This is the what the entity has done since then:

Data not yet verified by the auditor that correspond to the accrued amount invested from 2018 to the second quarter of 2019.

Green transactions listed with the main transactions

BBVA is once again in the vanguard and setting the bar in banking, thanks to its vision of financing with a view to the future. BBVA's green commitment were also reflected in some milestones achieved in 2019. Some of these highlights include:

-

Product framework

BBVA has developed a sustainable transactional product framework linked to the UN Sustainable Development Goals (SGD), for qualifying its clients’ transactional banking operations as green, social or sustainable. This industry-first methodology has been reviewed by and obtained a favorable opinion from sustainability ratings agency Vigeo Eiris, and is making its market debut with a transaction by Siemens Gamesa Renewable Energy, a BBVA strategic client. -

Green + 'blockchain'

BBVA Group issued the first structured green bond using blockchain technology to negotiate the terms and conditions. It is a private placement in which MAPFRE invested €35 million six year term bond linked to the evolution of the five year euro swap rate. With this bond issue, the BBVA Group demonstrates that it has the means, knowledge, and commitment to provide its clients cutting-edge products based on the latest technologies and innovative sustainable solutions.

-

'Just transition' concept

Iberdrola has successfully signed, with BBVA acting as lead arranger and sustainable agent, a new €1.5 billion multi-currency syndicated credit facility linked to sustainability criteria. This is the first transaction aligned with the ‘just transition’ concept, introduced in the Paris Agreement..

-

Sustainability coordinator in Asia

The agribusiness company COFCO International has signed the first syndicated sustainability-linked facility arranged by a Chinese corporate with the help of BBVA. The financing is for a total of $2.1 billion comprising three tranches – a 1-year revolving credit facility (RCF), a 3-year RCF and a 3-year term loan – each tied to sustainability criteria.

-

Sustainable agent

BBVA served as sole sustainable agent in the first syndicated revolving credit facility in Latin America, signed with Fibra Uno, a strategic client for the bank. The transaction is also the first sustainable transaction by a real estate business in the region and the first facility to be arranged in accordance with the ‘Sustainability-Linked Loan Principles’ in Latin America. BBVA was also the joint bookrunner and lead arranger in the transaction, which involved a total of 11 banks.

-

Green bond

Generali has just issued, together with BBVA and seven other banks, its first green bond amounting to 750 million euros. This is the first bond from a European insurance company and the largest to date. BBVA acted as deal manager and joint bookrunner.The new issue forms part of the Generali Group’s sustainability strategy and represents an important step in fulfilling its commitments in this regard, as it is the first green bond issued by the company. The proceeds of this inaugural bond will be used to finance sustainable buildings, including the development of the CityLife project in Milan.

Between 2016 and 2018, BBVA's financial literacy programs around the world benefited more than 11 million people. This financial institution remains committed to continuing to provide financial capabilities for the most disadvantaged groups, through initiatives aimed at reducing the equality gap, training programs and accessible digital financial solutions.

BBVA achieved a new milestone in education in 2019: 'Learn together' reached 500 million views in just 18 months. Also, the educational program that BBVA runs in collaboration with El País and Santillana, aiming to promote and position education as one of the priorities for our society, can be listened to on the BBVA Podcast.

The Frontiers of Knowledge Awards, the prelude to the Nobel Prize

Tbe 2019 Nobel Prize in Economics recognized the work of Abhijit Banerjee, Esther Duflo and Michael Kremer, for "their experimental approach to alleviating global poverty"; they were recognized by the BBVA Foundation in 2008.

The first two are the founders of the Massachusetts Institute of Technology's (MIT) Abdul Latif Jameel (J-PAL) Poverty Action Laboratory, while Mr Kremer is also an affiliated professor at J-PAL. This laboratory, which comprises MIT economists, fosters the use of scientific methods to assess the effectiveness of development aid funds.

Ten Frontiers of Knowledge award winners have already been recognized by the Nobel committee, making it a real prelude to the Swedish Academy's Awards.

This year, the Frontiers of Knowledge Award ceremony moved from Madrid to Bilbao.

One of the keys to BBVA's transformation in 2019 has been 'Agile': a journey of continuous transformation. The bank has achieved a pioneering milestone in the business world: it has transformed the way more than 33,000 people are organized and work in the Group's central services, incorporating the 'agile' methodology into their day-to-day lives. For BBVA, this achievement represents a decisive turning point in its transformation process and an opportunity to reflect on the steps taken to get here.

One of the challenges for any organization is knowing how to prioritize its projects. Paradigms and ways of working have changed, and companies must also change the way they decide what efforts they are capable of undertaking. Execution capacity and financial resources are not infinite, so it is essential to ensure that actions are not duplicated and that they are focused on achieving the corporate strategy.

To achieve this goal, as part of its 'agile' transformation process, BBVA has developed a project prioritization model, known as the 'Single Development Agenda' (SDA), which applies to all projects proposed in the Group.

BBVA's new productivity and work-life balance measures aim to transform these areas and have been part of its transformation in 2019.

The plan includes several initiatives, which fall into two main areas. Firstly, good practices to achieve efficient use of time. And, secondly, "more visible, shock measures", which include digital disconnection and the closure of the bank's corporate headquarters in Spain from 7 pm. The services provided in corporate buildings (canteens, transport, gym, etc.) are being adapted to this timetable.

This new productivity and work-life balance plan includes the register of hours in Spain. At the end of September, BBVA was the first Spanish financial institution to reach agreement with the trade unions on the registration of the day, going even further and including the right to digital disconnection. Employees will not be required to be connected after the end of their working day or during holiday periods. In addition, no communications will be sent between 7 pm and 8 am the next day, except when there are justified exceptions.

BBVA, the world leader in mobile banking for the third consecutive year

In 2019, for the third consecutive year, BBVA was recognized as the world leader in mobile banking, in 'The Forrester Banking Wave™: Global MobileApps Summary, 2019' report by Forrester Research. This international consultancy highlighted that BBVA combines "excellent functionality with the best user experience". Garanti BBVA, the group's franchise in Turkey, was also in second place for the second year in a row, being one of the first banks to launch a voice-activated virtual agent in the app.

In addition, the digital registration process, based on biometric identification technologies, which is already available in Spain, is now spreading to other geographies, thanks to reuse of components designed with a global perspective.

2019 has seen unparalleled digital activity in Latin America. BBVA lived up to its commitment to deliver differentiating products and services that continually enhance the customers’ banking experience. Mexico stood out thanks to its use of artificial intelligence, as did Argentina. While Peru and Uruguay continued to develop features in their respective applications, with Uruguay focusing on 'Mis viajes’ (‘My trips’) digital solution. Additionally, in Colombia, the company's fund management unit offered its customers a totally digital investment fund.

BBVA's new brand identity

BBVA has rolled out its new brand identity worldwide. The identity presented reinforces BBVA's objective of offering a unique value proposition and a consistent user experience based on technology and data, allowing us to help our customers manage their finances.

-

1

1Mexico

-

2

2Peru

-

3

3Colombia

-

4

4Uruguay

-

5

5Turkey

-

6

6Spain

-

7

7USA

BBVA'Be yourself'

At BBVA we value diversity and we are proud of this. Working together, we are building an inclusive work environment where we can be who we are, a place where our employees can be themselves. In addition, we have embraced diversity as a positive factor for the team and business.

With regard to gender diversity, the number of women among top executives rose significantly, reaching 18% of the total (compared to 5% before the organizational restructuring in December 2018). BBVA also seeks to have women make up 30% of its board of directors in 2020.

BBVA's gesture of solidarity — illuminating the Madrid headquarters building with the colors of the Pride flag — occurred in conjunction with the ‘Be Yourself' campaign, an employee-led campaign aimed at raising awareness about the need for LGBTI diversity in the workplace. Ízaro Amilibia, who spearheaded the initiative, speaks to us about her personal experience as a member of this group.

Cenyt case

Creation of a microsite with all communiqués made by BBVA on the Cenyt case over the year.