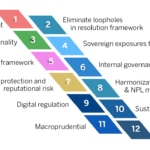

12 regulatory trends for the financial industry

BBVA Research has analyzed the potential regulatory scenarios that the financial industry will be facing in the next 5 to 10 years. In its Financial Regulation Outlook report, BBVA Research analysts address some of the questions being asked in Europe over the course and pace that regulators will choose in the medium and long term.

As BBVA Research points out, being aware of potential trends is essential for banks at the time of anticipating new scenarios. Understanding where EU banking regulations are heading requires, first and foremost, understanding the current regulatory framework, and, secondly, taking into account the debate about EU’s future in the aftermath of Brexit.

What are the 12 possible regulatory trends that EU banks could be facing?

Financial Regulation Outlook - BBVA Research

- Increased simplicity in capital requirements, with consequent reduced risk sensitivity in prudential frameworks, an issue already being subjected to debate within the context of the Basel III framework.

- Modification of the resolution framework. Recent resolution cases in Europe have evidenced that the current framework needs to be revised to build on the idea that taxpayers should not shoulder the cost of any crisis, but by its creditors

- Greater proportionality in financial regulation and supervision, and convergence with accounting practices. Convergence between the regulation and supervision standards, on the one hand, and the accounting framework, on the other, should be promoted, given the increasing importance of the latter.

- Treatment of sovereign exposures. According to the report, the EU will need to address the regulatory treatment of sovereign exposures, a complex topic that will require a lengthy regulatory debate. Even were it to be approved now, such a measure would need domestic legislative implementation in the EU, accompanied by a long transitional period to allow banks to manage their exposures.

- Advances in EU Institutional framework reform and political integration. According to BBVA Research, steps are likely to be taken within the next few years to enshrine the Fiscal Compact and the ESM in EU Law. Over a longer time-frame, a “little progress in setting up a common Treasury, which could be tasked with issuance of the new common debt instrument” could be expected. Nevertheless, for these institutional projects to be matured, first it would be necessary to complete the Banking Union and the Capital Markets Union.

- Increasing the importance of internal governance for decision-making and the alignment of compensation incentives

- More focus on topics relating to consumer protection and reputational risk. There is a trend towards concentrating on the protection of retail customers and stepping up financial education in all regulatory frameworks.

- Harmonisation of supervision & NPL management. BBVA Research notes that the ECB is already addressing this issue, and therefore "it is very likely to continue making progress" along this line.

- More focus on digital regulatory frameworks. BBVA Research’s forecast is that supervisors will prioritize FinTech and coordinate national initiatives to promote innovation and strengthen cybersecurity.”

- Development of sustainable finance. Future legislation will promote sustainable finance, while ensuring financial stability, considering environmental, social and governance-related factors and risks.

- Centralization of macroprudential regulation and an increasing focus on systemic entities. Macroprudential regulation and supervision are expected to take on increasing importance, featuring centralization through a more effective European Systemic Risk Board.

- Possible deregulation. BBVA Research does not rule out the possibility of deregulation if third countries, such as USA, or the UK as a consequence of Brexit go along such path.